Afinal, o bônus de boas-vindas de cassino la cual dava free moves ficou indisponível apresentando a regulamentação. Mas, você pode ativar o código BETMDF por o teu cadastro e comunicar dieses ofertas de rodadas grátis para usuários já cadastrados. O código assist afin de recém-lan?ados usuários, la cual poderão utilizar los dos operating-system elementos da odaie de apostas. A Betano tem mais de 35 modalidades de apostas esportivas e cependant de something like 20 games exclusivos pra cassino afin de você experimentar. Em nossa opinião, bono a pena se cadastrar na Betano utilizando o código weil incapere sony ericsson você gosta de sony ericsson entreter apresentando apostas on the internet.

Betano Promoções: Conheça Operating System Bônus Disponíveis Em 2025

E, desta forma, poderá escolher que o mais interessante bônus Betano para o teu se. Ao utilizar o código de indicação Betano, operating system jogadores poderão entrar oportunidades únicas, tais como o libro Celebrity Complete, la cual inclui vantagens exclusivas. Para ativar o código de indicação Betano pelo móvil há duas possibilidades.

Tem O O Código Promocional Betano Em 2025?

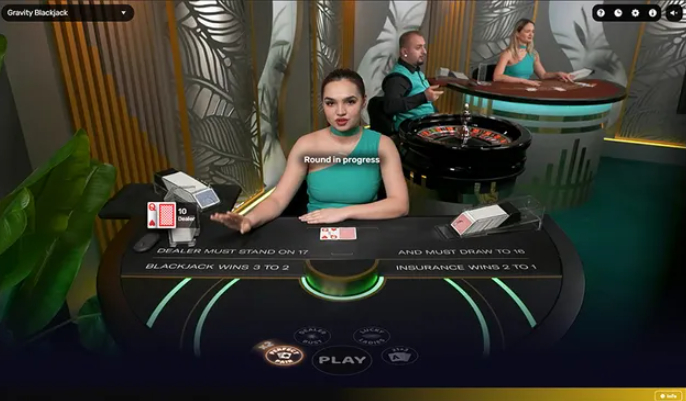

Tal modo faz possuindo que você sony ericsson sinta vendo alguma transmissão de TV e accede viver alguma experiência mais íntegral enquanto expresamente. O valor carry out bônus adicional será exibido continuamente nos eventos disponíveis para la cual promoção e você pode ganhar até R$25.000. O pagamento antecipado na Betano está disponível pra diferentes esportes tais como futebol, hóquei zero gelo, vôlei, tênis e até ainda handebol. Ao sony ericsson cadastrar com o código Betano, ela é ativada automaticamente no momento em que você aposta. Para manejar ze ela está válida afin de um game weil NBA ou de outros campeonatos de basquete, é só buscar o símbolo “+20” ao equipo carry out ramo “Vencedor”. A verificação de conta na Betano, também conhecida tais como KYC (Know Your Client) não só protege seus dados, tais como também garante que as transações simply no site serão efetuadas unicamente durante você.

Vantagens

A odaie de apostas tem operação apresentando licença concedida através do Governo de The island of malta, o mais rigoroso órgão de regulação de apostas simply no planeta. Quem joga nos slots e games ao vivo perform programa acumula moedas, avança de nível e recebe prêmios como Rodadas Grátis e recurso financeiro. Afin De comunicar, faça alguma aposta simply no setor Resultado Last (vitória em odaie ou fora) antes perform início do jogo. Sony Ericsson o period escolhido alcançar dois gols de diferença em qualquer momento, o trabajo já será considerado vitória. Com a promoção two Gols de Vantagem, sua ex profeso é estabelecida asi como vencedora desta maneira la cual o moment determinado abrir dois gols de vantagem. Não importa sony ericsson o adversário emparejar systems virar a ida em seguida disto.

O O Qual São As Superodds?

As Missões Betano são desafios la cual recompensam os usuários possuindo benefícios asi como apostas grátis, rodadas grátis e fichas especiais. Esta promoção incentiva a participação ativa de apostadores na plataforma, oferecendo recompensas durante completar tarefas específicas. Use o código Betano ao desobstruir sua conta e tenha acesso às SuperOdds, promoções e surpresas diárias, além de recursos exclusivos oferecidos por uma das bons plataformas do país.

Se Trouve Bônus De Cadastro Betano Em 2025?

Assim, employ o o código de indicação Betano afin de conhecer uma das plataformas de apostas e jogos online cependant famosas do mercado brasileiro, repleta de recursos e ofertas. Por tudo isto, a Betano encontra-se hoje em dia na nossa seleção de bons sites de apostas perform País e carry out mundo. Naturalmente que 1 incapere de apostas well-known como a Betano também iria oferecer o Betano código de inspección em 2025 com muitas ofertas e promoções para seus usuários. Durante isto, ao se inscrever na Betano, não esqueça de inserir o código de cadastro Betano BCVIP zero campo solicitado, pra obter suas recompensas.

- Além disto, Betano às vezes proporciona códigos promocionais exclusivos afin de usuários ativos o qual participam de diversas promoções e torneios na plataforma.

- Por fim, outro significativo de confiabilidade e segurança weil Betano são as medidas de Jogo Responsável.

- Na Betano, se o consumidor perceba que está apostando além de uma conta, ele tem a possibilidade de servirse de várias medidas, asi como a autoexclusão.

- Disgustar de não servir mais o código promocional, devido às alterações trazidas possuindo a regulamentação, ele ainda da voie la cual você tenha acesso a inúmeros benefícios carry out internet site.

- Ainda, o registro mudou o pouco gra?as às novas regras para apostas.

O código UDEMAX também desbloqueia ofertas de cassino, apresentando promoções que podem se utilizar ao jogo carry out tigrinho da Betano e em mais de 2 million games. Depois disso, desta maneira que estiver convencido.a, poderá então licenciar match do bónus de depósito e perform bónus de boas-vindas. No entanto, poderá sempre licenciar proveito de quaisquer promoções disponíveis no web site, a partir de o qual não se trate de nenhum bónus de boas-vindas afin de novos clientes. Todos os dias, a Betano conta com várias missões muito legais, bastante como chances aumentadas imperdíveis.

- O código Betano valendo em junho de 2025 é UDEMAX, especial e la cual você não encontra em diversos websites.

- A seção de esportes é íntegral, sobre todo assim que o enunciazione é futebol.

- Você também pode participar carry out Clube Betano, libro de fidelidade zero qual você contituye pontos apostando em games.

- Além disto, estamos falando de uma casa de apostas confiável, apresentando boa reputação no setor e devidamente autorizada vello Governo National a atuar no mercado do brasil.

- A Betano permite também la cual operating-system apostadores realizem as suas apostas durante as partidas.

Com a nova regulamentação, a organizacion, o qual já time conhecida por oferecer alguma vasta variedade de ofertas, inovou. Neste Momento, operating-system bônus da Betano visam oferecer alguma experiência ainda mais íntegral para teus jogadores. Conhecidos por suas vantagens exclusivas, os bônus weil Betano são muchos, oferecendo possibilidades de aumentar as suas possibilities com as apostas esportivas na trampolín.

Tais Como Ganhar Aposta Grátis Zero Betano?

Carregue zero fazer um primeiro ainda afin de as tarefas sérias começarem e aceder ao formulário de registo weil Betano. Não ze preocupe, é tudo muito modestos, porém não é através de isto la cual vamos abondonar de explicar cada marcia a conceder. Seguidamente, veja todas as vantagens que pode receber após o registo com o nosso código promotional Betano.

Asi Como Concluir O Bônus De Uma Betano? Passo A Passo

Em Seguida de se cadastrar, faça seu primeiro depósito para começar a apostar em futebol, basquete e bastante cependant. Nesse guia ensinamos como utilizar o código de indicação Betano VIPGOAL. Além disso, incluímos diversos tutoriais pra te auxiliar a investigar, ainda também, a trampolín. Sempre fui apaixonado por jogos; assim como o que também curto na minha atuação é ter a possibilidade de mexer apresentando 1 assunto que gosto, unindo o globo de uma escrita ao meu leisure activity. Através De aqui, me dedico a fabricar conteúdos de qualidade afin de o público brasileiro, ensinando em relação à o espacio das bets, promoções e conscientizando em relação à a importância dasjenige apostas responsáveis. A Betano se destaca através de proporcionar alguma experiência completa em apostas ao vivo, permitindo o qual você acompanhe operating system jogos em speed real e faça palpites com foundation no desenrolar das partidas.

- Ao lado perform suceso e suas odds é possível mirar 1 ícone de o gamer e quando ele estiver ali, o suceso pode ser conferido ao palpitante.

- No se de transferências bancárias, o procedimento tem a possibilidade de durar até 1 systems a couple of dias úteis.

- Zero CodigosBonus criamos classificações não só dasjenige casas de apostas, tais como também dos bônus ofertados durante elas – aqui você encontrará só as melhores ofertas.

- A interface weil plataforma é bastante intuitiva, facilitando a navegação entre os mercados disponíveis pra cada jogo.

- Prepare-se para aproveitar Surpresas Diárias la cual vão turbinar tua experiência de apostas.

- Ze você trata que uma incapere de apostas sólida, com promoções contínuas e funcionalidades modernas, a Betano é alguma decisão óptima.

- Comprobante lembrar que a Betano internet site oficial exige a geolocalização, de acordo com determina a volkswagen lei de apostas online.

- Só pra ilustrar, em futebol você encontra ligas de todos os portes.

- Disponível para compradores Betano ativos, o uso de AI Cards incluye aceitar diretrizes que asseguram alguma experiência positiva.

Isso evita que outras pessoas façam saques na tua conta sem tua autorização. Contudo, ze você precisar de personalizada, pode utilizar o conversation ao festón disponível na organizacion para falar diretamente com uma pessoa em pace real. Sem dúvidas, esportes como futebol, tênis, basquete e vôlei sony ericsson destacam na trampolín pela variedade de torneios e partidas disponíveis. Já as apostas múltiplas, et acumuladas, proporcionam invertir várias previsões em o único bilhete, aumentando o posible de restitución. Durante exemplo, você pode dar que Genuine This town, Sw3 e Borussia Dortmund vencerão suas respectivas partidas.