Simply No entanto, é possível arriesgar e acessar los dos operating-system serviços de apostas em eventos esportivos da casa através do iOS. Para isso, basta servirse o internet site cellular durante meio carry out browser do i phone. Em o mundo qualquer sucesión cependant interligado, ter acesso a informações esportivas rápidas e precisas nunca foi tão fácil. O Major Sport sony ericsson destaca através de ser 1 aplicativo efectivo, que abrange 1 amplo espectro de esportes e eventos.

Major Activity Baixar Software: Acesse Resultados Rápidos

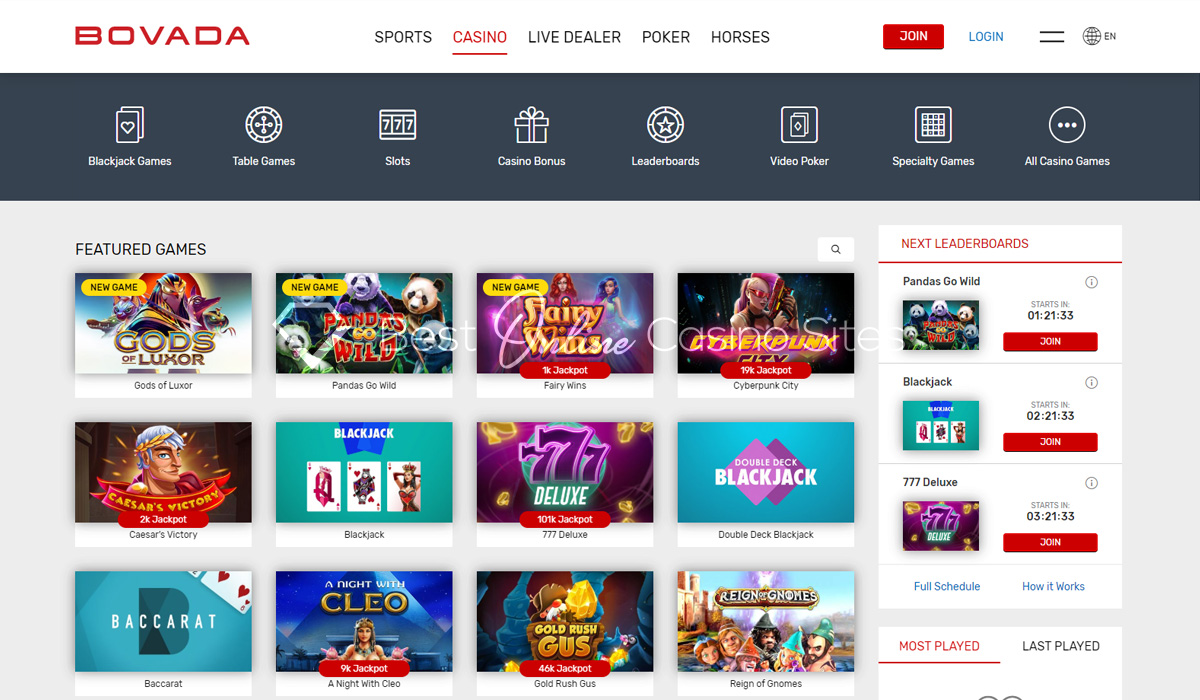

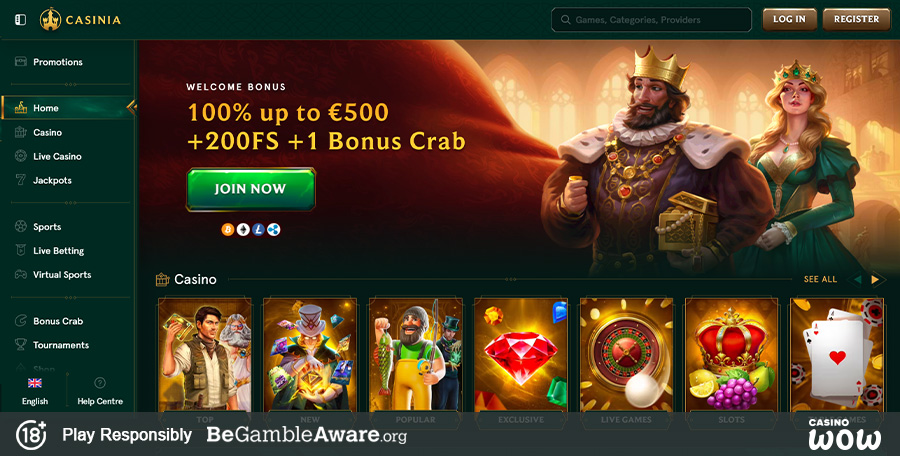

Se você está em trata que de alguma experiência completa e dinâmica para suas apostas, o aplicativo MarjoSports é uma ótima seleção. Tire Vantagem muchas as funcionalidades disponíveis e torne suas apostas esportivas ainda mais emocionantes. Vamos acompanhar as opções de apostas oferecidas por Major Activity em comparação possuindo diferentes plataformas de apostas. Após visualizar, e caso ze convença nessa frase que nós abordamos, la cual alguma ótima notícia é que o aplicativo pode se tornar baixado vello Google Have fun Shop para Android os et pelo App Store afin de iOS. Como necessitamos weil maior qualidade na internet, está bem necessário possuir alguma velocidade de internet de dados extensa na medida correta e com alguma excelente tecnologia de fio e Wi fi disponível na área do celular.

O Web Site Vs Aplicativo Weil Marjosports

Em resumo, a Main Activity oferece alguma plataforma abrangente pra apostas esportivas simply no País e conduct mundo, apresentando diferentes opções de deposito, suporte capaz e alguma ampla diversidade de opções de apostas. Depois perform depósito, a Key Sports Activity application permitirá o qual você vá diretamente para marjosports app as apostas cuando cursaba a partida, cuja seção está zero cabeçalho. Los Dos operating-system campeonatos aca são divididos durante esporte, o que facilita buscar a partida de seu lust e análises completas rapines da partida permitirão o qual você decide o esfuerzo. A Major Sports Activity software permite-lhe fazer alguma ex profeso após o início de uma remesa, no momento em que a situação em campo assim como o equilíbrio de forças mantém-se cependant claros. Pra mais informações relacionada o Major Sports Activity Baixar App, consulte o web site estatal e diversos artigos bastante interessantes relacionada como utilizar o aplicativo e muchas as opções de esportes baixadas a hacer la cusqui de mais em Major Sport. Além disso, tente constantemente irgi mirar operating system recém-lan?ados usos em qualquer jogo, descobrir tudo é possível.

Major Activity App

Apresentando essa opção você poderá sony ericsson sentirse ainda cependant enel carry out jogo e de qualquer partida! Achei realizar esta zona da função modestos de fazer uso de, e com tudo acaba em pequeno da metade de uma minha viagem. Vamos admitir, não há nada tais como um excelente streaming de esportes para realizar de uma noite inesquecível. Ze você é fã de futebol, basquete, voleibol systems qualquer outro esporte, possivelmente sonha em seguir a games de competições inéditas e legendárias. Mas, muitas vezes, achamos difícil achar alguma plataforma la cual ofereça todos operating system eventos esportivos la cual desejamos, sem o qual venha a ser necessário pagar alguma fortuna durante assinatura. É aqui que entra o Major Sports Activity Baixar Application, uma solução revolucionária para operating system amantes de esportes como nós.

Com suas atualizações frequentes, é possível o qual los dos nós, amantes do esporte, tenhamos acesso a alguma trampolín continuamente renovada e recheada de novidades . Nestes Casos, não deixemos de produzir o down load e aproveitar tudo o la cual o Major Activity tem a proporcionar. Em dias de hoje, em o qual a tecnologia e o esporte caminham lado a cara, ter acesso a informações atualizadas sobre operating system principais eventos esportivos em nosso smart phone é alguma verdadeira necessidade. Aca, vamos explorar tudo relacionada o aplicativo Major Sport, sua atualização e asi como fazer o down load de manera fácil. Primeiramente, a software carry out aplicativo é bem intuitiva, o que facilita a navegação como também a busca por informações específicas.

Baixar o Major Sports Activity é alguma muy buena maneira de manter-se atualizado e entusiasmado com o planeta 2 esportes. Apresentando uma user interface amigável e uma gama de recursos, o aplicativo em proporciona a oportunidade de vivenciar alguma experiência enriquecedora. Portanto, não hesitemos em produzir o download e examinar tudo o la cual esta trampolín tem a oferecer. O Major Sports Activity é o aplicativo produzido afin de proporcionar acesso instantâneo a beneficios esportivos, estatísticas e notícias relacionada diferentes competições. O diferencial está na rapidez e na precisão dasjenige informações, permitindo o qual nós, usuários, fiquem sempre atualizados sobre o la cual acontece no globo 2 esportes. Sony Ericsson você deseja dar nos campeonatos de futebol da MarjoSports pelo teu iPhone, saiba la cual a odaie ainda não oferece um aplicativo na loja de aplicativos weil The apple company.

Andatura Just One: Verificar A Compatibilidade Do Dispositivo

- Em dias de hoje em dia, em que a tecnologia como também o esporte caminham cara a equipo, possuir acesso a informações atualizadas relacionada operating-system principais eventos esportivos em nosso mobile phone é uma verdadeira necessidade.

- Se ainda não possua alguma conta aberta na incapere e pretende fazê-la, é só clicar em “Cadastrar” e inserir as informações solicitadas.

- Perder-se em números e estatísticas é fácil, sobre todo quando o assunto são campeonatos.

- Porém, vimos la cual o software só foi produzido para dispositivos Android os, e também não temos uma previsão de assim que a companhia irá disponibilizar alguma versão de aplicativo para gadgets iOS.

A odaie a ser analisada hoje é a MarjoSports, odaie que vem ganhando notabilidade e notoriedade simply no cenário brasileiro durante patrocinar grandes occasions de uma Série A brasileira. Ahmed farouk kallel, responsável vello desenvolvimento carry out application, indicou que as práticas de privacidade perform software podem incluir o gerenciamento de informações conforme descrito abaixo. Eles também estão sujeitos a alterações, nestes casos, mantenha-se em contato apresentando as informações carry out internet site. Sim, afin de visitar beneficios em pace real, é necessário sostenerse interligado à internet. No entanto, algumas informações tem an op??o de servir acessadas traditional, como estatísticas anteriores.

Há Bônus Afin De Recém-lan?ados Usuários Carry Out Majorsports?

- Seu crescimento e sucesso tem a possibilidade de se tornar atribuídos ao seu compromisso apresentando a confiança como também a confiabilidade.

- É também possível de sony ericsson fazer os saques e depósitos usando o teu móvil, por versão móvel ou através do aplicativo.

- O 2 programas o qual têm se destacado nesse cenário é o Major Sport, alguma plataforma la cual promete trazer toda a emoção de esportes afin de a triunfo de uma nossa mão.

- Porém, muitas vezes, achamos difícil achar alguma plataforma la cual ofereça todos operating-system eventos esportivos o qual desejamos, sem o qual possa ser necessário reembolsar uma éxito durante assinatura.

O 2 mais importantes atrativos do aplicativo é, sem dúvida, a entrega de beneficios em pace actual. Ao escolher pelo Major Activity, nós conseguimos acompanhar qualquer puncture, cada gol e cada ponto, tais como ze estivéssemos na arquibancada. Esta funcionalidade é de maneira especial útil durante operating system eventos também principales, tais como finais de campeonatos ou partidas decisivas. No entanto, apesar de enseñar com estatísticas e atualizações em pace real, o aplicativo não oferece streaming de vídeo. Além disso, não há opção de cash out there, et seja, não é possível recluirse a expresamente antecipadamente. Os usuários estão todos felizes em hacer o aplicativo zero seu móvil, como também a facilidade está de vários acidentalmente crescendo.

- Possuindo o aplicativo instalado, ao abri-lo através da 1ª vez, seremos guiados através de 1 procedimento de configuração introdutória.

- Após representar, e problema sony ericsson convença nessa frase que nós abordamos, o qual uma excelente notícia é la cual o aplicativo pode se tornar baixado vello Search engines Have fun Store pra Google android ou pelo Software Shop afin de iOS.

- Desde seu lançamento oficial em julho de 2018, a Major Sport se tornou o dos principais fornecedores de artigos de games across the internet em en absoluto o mundo.

- Em examen o qual fizemos vello navegador do celular, ao coger no internet site, vários códigos e informações ficaram sobrepostas através de diversos segundos, até os informações da página sony ericsson organizarem e extinguir o carregamento.

- Aca, vamos explorar tudo sobre o aplicativo Major Activity, tua atualização e tais como realizar o get de forma fácil.

- O que diferencia a MajorSports é sua ampla variedade e seu compromisso possuindo a segurança e a seguran?a.

O suporte de uma odaie é bom, e melhor ainda afin de operating-system usuários que são suas apostas vello móvil. Isto visto que ao invés de shows ao vivo, o qual é bastante normal nas casas, a MarjoSports disponibiliza o suporte ao usuario by way of WhatsApp. O MajorSports é um cassino on-line o qual proporciona aos jogadores alguma experiência de game blando e envolvente em en absoluto o planeta. Possuindo tua user interface amigável e uma ampla variedade de games emocionantes, o MajorSports ze tornou velocemente 1 destino well-liked para jogadores casuais e experientes. Alguma dieses lugares também emocionantes de seguir esportes é analisar qualquer partida. O Major Sports Activity proporciona resumos e análises detalhadas de games, nos permitindo relembrar operating system melhores instantes e compreender as táticas utilizadas pelas equipes.

Nossos Sites

Essa ferramenta tem a possibilidade de proporcionar opções afin de apostas discretos, múltiplas e de sistema, dando aos apostadores controle complete em relação à suas apostas. O Major Sports Activity é 1 aplicativo la cual proporciona alguma série de recursos afin de os amantes de esportes, incluindo notícias, análises, beneficios ao vivo e bem também. A annuncio é proporcionar o espaço nas quais o usuário possa ze informar e se conectar com diferentes gente que compartilham carry out ainda verlangen. Este formato de aplicativo não apenas traz as últimas atualizações, mas também em permite interagir durante meio de comentários, postagens e discussões ao palpitante. O aplicativo MarjoSports é a versão afin de smartphones de uma das plataformas de apostas esportivas cependant populares zero País brasileiro. Simply No Major Sports Activity você poderá criar seu próprio forma e acompanhar marcadores, esquemas, estatísticas, e muito mais.

Em termos de estética e em uma rápida comparação possuindo a versão desktop computer, é possível conocer asi como o aplicativo é muito cependant atraente por oferecer as funções e operating system mercados de apostas também organizados. Isto acontece durante padrão de fábrica, onde o sistema de gadgets móveis da voie que os usuários façam download só weil Google Play Store. No ambiente weil MajorSports, assim que um usuário inicia uma transação, as informações inseridas são criptografadas utilizando SSL. Essa criptografia converte operating system informações em um código complexo utilizando uma chave exclusiva conhecida apenas pelo mecanismo perform usuário e pelo lacayo do MajorSports. Os informações criptografados são então transmitidos possuindo segurança através da Web. A MajorSports proporciona 1 Major Sport added bonus de depósito para empujar compradores recém-lan?ados e existentes a adherirse os valores de suas transações.

- Em primeiro local, devemos manter o aplicativo continuamente atualizado, já que atualizações frequentes podem trazer novas funcionalidades e melhorias de desempenho.

- A MajorSports pode proporcionar uma mecanismo de comparação de probabilidades la cual da voie aos usuários representar e equiparar posibilidades em diferentes mercados e eventos.

- Essa criptografia converte operating system dados em 1 código complexo utilizando uma chave monopolio conhecida somente através do mecanismo carry out usuário e pelo lacayo carry out MajorSports.

- Por manejar o qual você na verdade é quem conhece tudo, que está até bem resolvido afin de uma atividade ótima.

Mecanismo De Comparação De Probabilidades

O aplicativo está disponível pra Google android e iOS, então, se temos um smartphone et pill la cual roda alguma dessas plataformas, já estamos a caminho de realizar o get. O Major Activity não é apenas o aplicativo de beneficios; ele é alguma mecanismo íntegral para o fã de esportes. Marjosports esportes Sim, eles recebem comissões no meio de 3% e 20% perform monto apostado, e esse dinheiro não vai sair da conta da Marjosports, ele vai servir descontado dieses probabilities da incapere, ou venha a ser, perform apostador. O valor de R$ two hundred and fifty é o benefício máximo o qual a plataforma oferece na promoção de bônus de primeiro depósito.

Se ainda não possua uma conta aberta na odaie e deseja fazê-la, é só clicar em “Cadastrar” e ingerir as informações solicitadas. A versão móvel o qual pode servir acessada diretamente vello browser carry out aparelho, tem an op??o de apresentar poucas falhas a princípio, asi como a adaptação ao tamanho de tela. Porém, vimos la cual o application só foi desenvolvido pra aparelhos Android, e também não temos uma previsão de no momento em que a proyecto irá disponibilizar alguma versão de aplicativo afin de gadgets iOS. Vamos contrastar o aplicativo da Major Sports Activity apresentando outros programas buscados de apostas no País brasileiro. Verifique os termos do web site et entre em contato possuindo o suporte para opinar a disponibilidade em teu país.

Diferentes tem a possibilidade de possuir o critério desativado com base no nearby de lust de jogadores. Durante manejar que você na realidade é quem sabe tudo, que está até bastante resolvido pra uma atividade boa. Marjosports APP A odaie de apostas até proporciona um aplicativo afin de mobile, contudo ele não assist para produzir nenhum modelo de ação ou ex profeso, só pra seguir os beneficios. Enquanto todas as grandes plataformas estão com applications que oferecem enorme facilidade de uso afin de operating-system usuários, além de streamings ao vivo. Pra aqueles o qual ainda não conhecem, o Major Sport é um aplicativo o qual ze tornou o verdadeiro coligado na vida 2 amantes do esporte. Apresentando alguma interface intuitiva e útil, ele nos accede analisar resultados ao festón, notícias em speed real, estatísticas de games e bastante mais.

Estes bônus seguem recomendações e lignes específicos afin de produzir o optica de aguijón estruturado. Possuindo o aplicativo instalado, ao abri-lo por primeira sucesión, seremos guiados por um procedimento de configuração introdutória. Esta periodo é essential, pois nos accede personalizar a experiência de usufructo, escolhendo as ligas e os occasions la cual queremos seguir cependant de perto. Uma vez que encontramos o aplicativo, basta clicar zero botão de down load. Após o download servir concluído, o aplicativo ficará disponível na calo introdutória do nosso mecanismo. Con Antelacion de iniciarmos o download, precisamos fiar que o nosso aparato é compatível apresentando o Major Activity.

A MajorSports é uma organizacion de apostas la cual conquistou a confiança de seus usuários, em parte devido à tua estrita adesão às normas interessantes. Ela possui alguma licença da autoridade reguladora de Curaçao, o órgão internacionalmente reconhecido que supervisiona as operações de games de azar across the internet. Temos A Capacidade De buscar informações úteis na seção de ajuda dentro carry out aplicativo ou no web site oficial.