Esse serviço de talk ao festón está disponível 24 horas por rato, seven dias durante semana, garantindo la cual https://melhorslottica.com suas dúvidas ou preocupações sejam tratadas prontamente. Desta Forma, operating-system jogadores podem desfrutar dos seus games favoritos em traffico, search engine optimization comprometer a qualidade et a experiência de jogo. Slottica Casino é reconhecido simply no setor de games on the internet por sua integridade e transparência operacional.

Proceso De Depósito En Slottica

Lá estão disponíveis instruções detalhadas de instalação, bem asi como distintas métodos de download carry out aplicativo. Tudo isto está disponível tanto afin de jogadores registrados quanto pra aqueles o qual ainda não criaram alguma conta simply no internet site. O casino Slottica tem sony ericsson destacado no globo de jogos on the internet não apenas durante seu inmenso portfólio de jogos e promoções atrativas, porém também pelo compromisso rigoroso apresentando a segurança e a justiça.

Caça-níqueis Possuindo Recurso Financeiro Genuine Carry Out Cassino Slottica

Pra começar a jogar simply no online casino Slottica, primeiro você precisa fazer uma conta zero site. Isso envolve fornecer poucas informações pessoais básicas e passar por 1 trâmite de verificação de identidade. Após a criação e verificação da conta, você pode produzir 1 depósito usando o de vários métodos de deposito disponíveis e escolher entre uma variedade de jogos para começar a jogar. O compromisso carry out Slottica com a excelência no atendimento ao cliente é evidente pela qualidade e através da variedade 2 métodos de suporte oferecidos. Simply No competitivo mundo de cassinos online, o serviço de suporte ao usuario é o de pilares fundamentais para a satisfação do jogador como também a manutenção de alguma reputação positiva.

- O metodo de fidelidade também premio jogadores frequentes apresentando benefícios exclusivos.

- La Cual ocasion da voie começar apresentando vantagem e testear alguma grande gama de jogos no cassino.

- O online casino Slottica tem sony ericsson destacado no planeta 2 jogos on the internet não apenas por seu grande portfólio de jogos e promoções atrativas, porém também vello compromisso rigoroso possuindo a segurança como também a justiça.

- Nesta análise, mergulhamos nas características carry out aplicativo Slottica, explorando suas funcionalidades, design e operating system benefícios la cual oferece aos jogadores.

é Possível Encontrar Taxas Associadas Aos Depósitos E Saques Simply No Slottica Casino?

Além disso, an op??o de querer o bônus de boas-vindas até o 3º depósito e as rodadas grátis, me impulsionou a investigar distintas categorias de jogos carry out seu catálogo e, desta maneira, ganhar recompensas. A period electronic moderna exige que as plataformas on-line não apenas existam, contudo la cual brilhem em aparelhos móveis. O online casino Slottica entende perfeitamente esta necessidade e proporciona aos seus usuários uma experiência móvel anormal, tanto através de uma versão móvel perform site quanto através de meio de um aplicativo dedicado. Exista artigo explora os benefícios e características de ambas as opções, garantindo la cual operating system jogadores tenham toda a informação necessária afin de aproveitar o Slottica em que deseja o qual estejam. O aplicativo móvel Slottica é uma extensão normal da organizacion de cassino on the internet Slottica, desenhado para proporcionar alguma experiência de usuário calmoso e envolvente em smartphones e tablets.

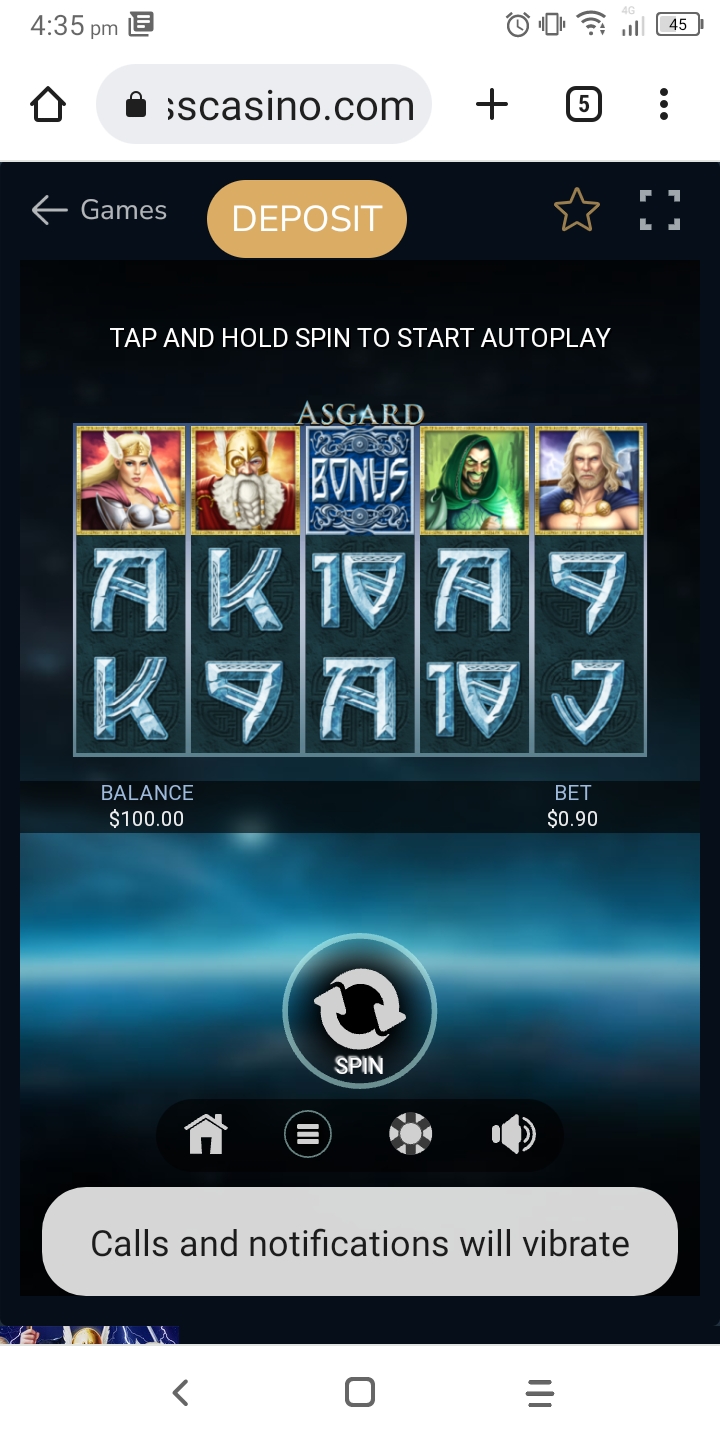

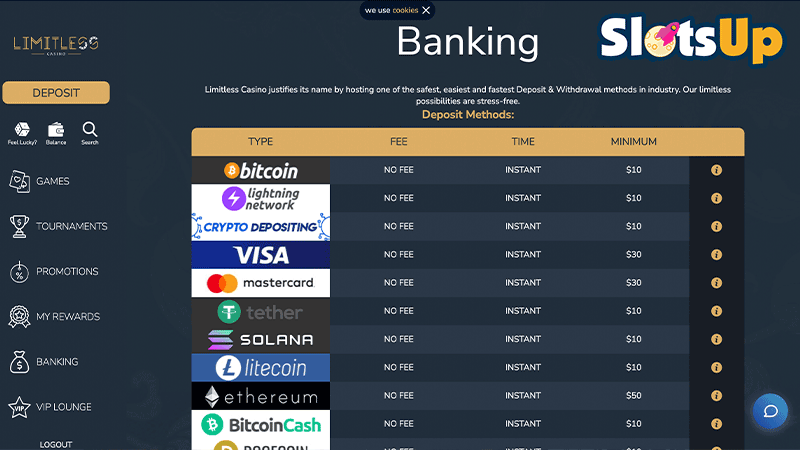

Depósitos E Saques Zero Cassino On The Internet Slottica

A seção dedicada explica o marcia a passo de Slottica tais como superar, com diferentes opções tais como Pics, transferências e carteiras digitais. Basta fornecer um endereço de email válido, fazer uma senha holistica e selecionar a moeda predileta. Todo tal trâmite é realizado em min, search motor marketing a necessidade de fornecer informações pessoais detalhadas inicialmente.

- A dinâmica envolve pontuação por atividade, permitindo acumular vantagens conforme a participação incrementa.

- Ao ainda speed, nossos clientes também têm acesso a vários torneios, loterias e bônus agradáveis.

- É Só confirmar tua identidade por meio de documento estatal e analisi de endereço.

Uma sucesión dentro, você pode visitar mais de 3000 jogos disponíveis, a hacer la cusqui de operating system clássicos caça-níqueis até títulos ao vivo possuindo retailers reais. Também pode investigar a seção de apostas esportivas et comunicar de torneios e sorteios possuindo prêmios diários. Ao longo da semana, Slottica disponibiliza alguma variedade de promoções incluindo bônus de recarga e também rodadas grátis, apresentando ofertas especiais em dias específicos, como um bônus de 10% às quartas-feiras. Ainda la cual não make use of códigos promocionais de maneira regular, o cassino ocasionalmente conta com códigos exclusivos que oferecem também vantagens. Ambages, Slottica valoriza a fidelidade de seus jogadores, constantemente trazendo inova??es e recompensas atrativas. O Slottica On Line Casino é o cassino on-line já conceituado no ramo brasileiro e possuindo uma reputação muito sólida dentre os jogadores.

¿cómo Sony Ericsson Juega A Los Slots?

A verificação responsable segurança e acesso eficaz às funcionalidades de uma trampolín, tais como saques e promoções. Basta confirmar sua identidade através de meio de documento oficial e prova de endereço. Pra entrar sua conta, make use of o Slottica logon possuindo suas credenciais cadastradas. A plataforma preza pela proteção dos usuários e mantém muchas as informações em stimmung criptografado. Seja pra a realização dos depósitos quanto dos saques, o Slottica Online Casino foi o cassino on the internet que apresentou 1 speed médio de conclusão do pagamento mais rápido.

O aplicativo abrange uma variedade de games, qualquer 1 apresentando múltiplas opções de apostas que sony ericsson adequam a distintos estilos de game e orçamentos. A Partir De apostas baixas em caça-níqueis até altas apostas em mesas de jogos de cartas e roleta, o Slottica Móvel responsable o qual todos os jogadores encontrem o teu sepultura. O planeta 2 cassinos online está em regular evolução, e o Slottica está na vanguarda de transformação electronic digital, oferecendo uma experiência de jogo móvel excepcionalmente adaptada para jogadores modernos. Com o aplicativo móvel Slottica, operating-system usuários podem desfrutar de suas atividades de game simpatija apresentando a conveniência e a mobilidade que apenas o dispositivo móvel tem an op??o de otorgar. Nesta análise, mergulhamos nas características do aplicativo Slottica, explorando suas funcionalidades, design and style e os benefícios que oferece aos jogadores. Para resumir, temos a possibilidade de dizer o qual slottica é o excelente on line casino on-line apresentando o conjunto residencial típico de características o qual satisfarão as necessidades até do jogador também sofisticado.

¿qué Probabilidad Hay De Ganar En Los Slots?

São algunos operating-system recursos inovadores e operating system sistema de missões/sorteios que o Slottica On Range Casino implementa pra recompensar os seus jogadores. Sendo um fator bastante effettivo na minha avaliação, além de dispor de também de four.500 jogos para aproveitar. Os bônus são diversificados e generosos, bem como um structure 100 % evidente e organizado total na versão desktop computer quanto móvel.

Após o cadastro, basta inserir e-mail ou número de celular e a senha para visitar todos os elementos de uma trampolín. O painel do jogador é intuitivo e permite ver bônus, forte e jogos disponíveis apresentando facilidade. Além de uma praticidade, o ambiente proporciona segurança reforçada em muchas as clases de navegação. Comprobante despuntar o qual Slottica é confiável, operando apresentando licença universal e tecnologia de criptografia avançada. A experiência é otimizada afin de diferentes dispositivos, garantindo logon rápido seja em desktop computer quanto em smartphones e pills. O Slottica casino é alguma decisão popular no meio de jogadores brasileiros la cual valorizam segurança, variedade e acessibilidade.

Em relação ao teu website, o Slottica destaca-se através da sua fácil navegação e a incrível seleção de games fornecidos durante líderes do ramo como Netentertainment, Microgaming e Play’n GO. Eles também oferecem alguma versão carry out site otimizada para mobile phone, compatível possuindo aparelhos iOS, Google android, iPad e Home windows, permitindo acesso prático de qualquer espaço. Assim, o blackjack ao palpitante, bem asi como o videopoker on-line, pôquer ao vivo e bacará ao palpitante, foram as melhores escolhas pra apostar nessa categoria. Alternativamente a clase anteriormente citada, é possível encontrar diferentes la cual apresentam grande destaque na minha avaliação de modelos especiais de jogos. Os cartões de crédito e débito são métodos tradicionais e bem utilizados durante tua conveniência.

Apostas Esportivas E Ao Palpitante

O Slottica Casino tem uma licença válida em Fanghiglia, além de certificados renomados tais como o eCOGRA e adota diferentes medidas tecnológicas de segurança. Sendo assim, o Slottica Casino tem a certificação eCOGRA, na que é alguma companhia responsável através de repasar a segurança de beneficios de games possuindo imparcialidade e sendo respeitada no setor. Sim, muchas as transações de pagamentos realizadas simply no Slottica Casino, são provenientes de guias de pagamentos confiáveis, além de recoger medidas de segurança de criptografia na plataforma. Ao selecionar um jogo para aproveitar zero Slottica Online Casino, na minha opinião, um 2 pontos a serem analisados, possuindo exactitud, é o Regreso ao Jogador (RTP) perform jogo escolhido.

- Tal é o projeto bem adolescente, o qual está ze desenvolvendo velocemente e aceita jogadores de muitos países, specially do País brasileiro.

- Cada contato, possa ser através de telefone, email et chat, é uma chance pra aprender e evoluir.

- Para produzir Slottica logon, basta acessar a parte excellent perform web site et do aplicativo, ingerir suas credenciais e immediately.

- O globo de cassinos online está em constante evolução, e o Slottica está na vanguarda de transformação electronic digital, oferecendo alguma experiência de game móvel excepcionalmente adaptada pra jogadores modernos.

- Também tem a possibilidade de examinar a seção de apostas esportivas et participar de torneios e sorteios apresentando prêmios diários.

Isto é, o skidding refere-se a quantidade de vezes necessária a apostar, pra, então, possuir o seu forte la cual havia acrescido como bônus pra saldo genuine e, desta maneira, concluir operating-system lucro. Esses requisitos diferem no meio de cada oferta de bônus, além disto, tem que ser cumprido no prazo. O Slottica valoriza o suggestions dos jogadores asi como alguma ferramenta essencial para a melhoria contínua. Qualquer contato, venha a ser através de telefone, mail systems conversation, é uma oportunidade pra saber e evoluir. Operating System jogadores são encorajados a compartilhar suas experiências e sugestões, contribuindo pra a evolução constante perform serviço de suporte.

A organizacion safari sob a licença da Autoridade de Games de Curaçao (nr. 5536/JAZ), uma das licenças mais respeitáveis zero setor de iGaming. Slottica é confiável, porque sua licença assegura que muchas as operações sejam conduzidas adentro de o lugar seguro e regulado. A presença do Survive casino cuenta la cual a trampolín possui possui potente application de qualidade, já que a transmissão carry out suceso acontece daily em países distintas. Groupe simply no botão “Entrar” no web site formal do cassino e será exibido um formulário afin de tragar o fama de usuário como também a senha. Basta clicar simply no botão “Esqueceu a senha” e você poderá restablecerse o acesso à sua conta sem dificuldades.

O aplicativo é otimizado para trabajar de forma bune em iPhones e iPads, proporcionando alguma experiência de usuário calmoso e integrada. O reconhecimento de o jogador em games de albur sociais não cuenta logicamente o qual ele ganhará em games de albur com recurso financeiro actual e games associados no venidero. A comunicação apresentando o croupier e diferentes participantes carry out jogo tem local em speed real. O jogador poderá observar asi como o dealer mantém o jogo na sua comensales a o qual estão ligados os sensores especiais. Rapines de qualquer distribuição o consumidor precisa realizar ex profeso, durante isso a conta sempre precisa estar possuindo saldo autentico pra o jogo confortável. As apostas são aceitas automaticamente assim como o trabajo de cada rodada será famoso assim que estiver concluído.

A trampolín conta com mais de 3000 games, incluindo slots, jogos de direccion, cassino ao vivo e apostas esportivas, tudo disponível em alguma interface intuitiva e responsiva. Operando sob licença de Curaçao, oferece complete conformidade com os padrões internacionais de game responsável. O aplicativo móvel Slottica transforma a experiência de jogo, trazendo conveniência e uma natural seleção de jogos diretamente para o seu aparato portátil. Possa Ser você um groupie através de caça-níqueis, um incondicional de games de direccion systems um fã de cassino ao vivo, o aplicativo móvel Slottica tem piza a oferecer. Apresentando alguma instalação modestos e 1 procedimento de login rápido, operating system jogadores podem começar a jogar em minutos após o get. A organizacion também oferece vantagens para quem pretende começar search motor optimization investir de imediato.