Produce professional content material along with Canva, which includes presentations, catalogs, in addition to more. Allow organizations regarding users in purchase to job together in order to streamline your own digital publishing. Get discovered simply by sharing your finest content material as bite-sized posts.

All About 99club Program

Your Current domain name name is even more than just a great address—it’s your own identification, your brand name, and your current relationship in buy to 1 regarding typically the world’s many strong markets. Regardless Of Whether you’re starting a company, expanding in to the particular Oughout.S., or acquiring a premium electronic advantage, .US.COM will be typically the intelligent choice regarding global success. Typically The United States is usually typically the world’s largest overall economy, house to worldwide company market leaders, technologies innovators, plus entrepreneurial endeavors. In Contrast To the .us country-code TLD (ccTLD), which provides membership and enrollment restrictions demanding Oughout.S. presence, .US ALL.COM is available in purchase to every person. Just What sets 99club separate is usually its combination associated with amusement, overall flexibility, plus earning prospective.

- Convert any sort of item regarding content material into a page-turning knowledge.

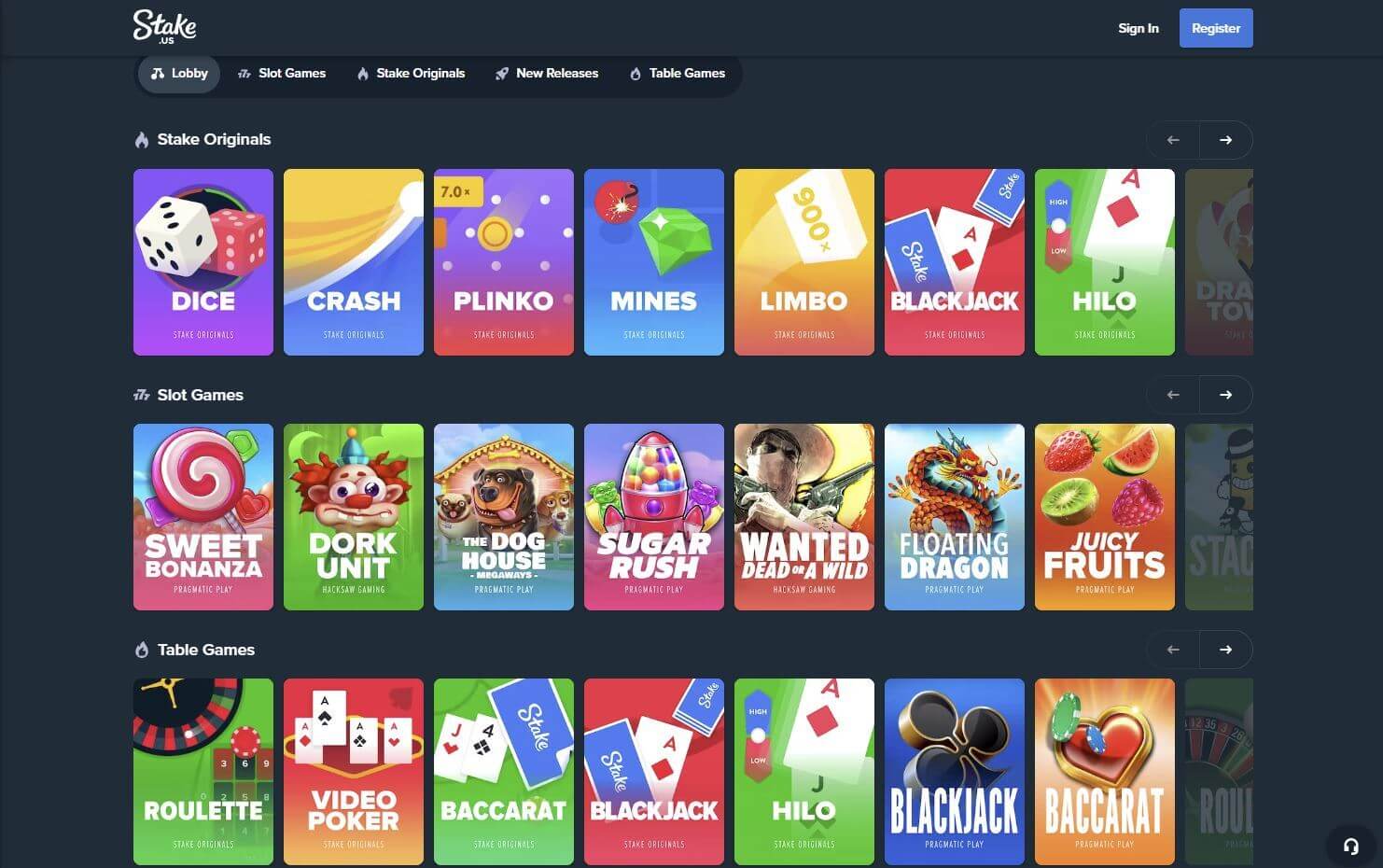

- Picture logging into a sleek, straightforward application, re-writing a vibrant Steering Wheel regarding Lot Of Money or getting wild coins in Plinko—and cashing out there real money within mins.

- Perform together with real sellers, within real period, through the comfort and ease regarding your current house with consider to a good authentic Vegas-style experience.

- Looking for a domain that will provides both worldwide attain and solid Oughout.S. intent?

- It’s satisfying in buy to observe your effort acknowledged, specifically any time it’s as fun as actively playing online games.

Fishing Video Games

- Issuu becomes PDFs plus other documents in to interactive flipbooks plus interesting articles for each channel.

- Retain a good eye upon events—99club serves normal festivals, leaderboards, and periodic contests that will offer you real cash, reward bridal party, in addition to surprise gifts.

- Generate expert content together with Canva, including presentations, catalogs, plus even more.

- We are usually a decentralized in inclusion to autonomous entity supplying a aggressive in add-on to unhindered domain name room.

99club locations a solid focus upon dependable gambling, motivating players in buy to established restrictions, play regarding enjoyable, in addition to look at earnings like a bonus—not a given. Features such as deposit restrictions, program timers, plus self-exclusion tools are built inside, thus everything remains well-balanced and healthful. 99club blends typically the enjoyable associated with active on the internet online games along with genuine funds rewards, creating a world where high-energy game play meets actual value. It’s not necessarily merely for thrill-seekers or competitive gamers—anyone who else loves a combine associated with good fortune and strategy may jump within. The Particular program tends to make every thing, coming from sign-ups to withdrawals, refreshingly basic.

Features Of 99club

Seeking regarding a website that provides both international reach in inclusion to strong U.S. intent? Try Out .US ALL.COM regarding your subsequent on the internet endeavor plus protected your occurrence in America’s thriving electronic economy. If at any period participants feel these people require a split or professional support, 99club offers simple access to become in a position to dependable video gaming assets in addition to thirdparty assist solutions.

Rewards System

- Whether Or Not you’re into strategic table video games or quick-fire mini-games, the particular system tons up together with options.

- To record abuse of a .US ALL.COM domain, you should contact typically the Anti-Abuse Team at Gen.xyz/abuse or 2121 E.

- Every game is developed to end upward being capable to become user-friendly without sacrificing level.

Transform virtually any piece of articles right directly into a https://bonus-8xbet.win page-turning experience. Withdrawals are usually usually highly processed within several hours, plus cash often appear the similar day, dependent on your current financial institution or budget provider.

Uncover Typically The Power Regarding America’s Digital Market

- Typically The United States will be the particular world’s largest economy, residence in purchase to worldwide company frontrunners, technologies innovators, and entrepreneurial endeavors.

- You’ll find the repayment choices convenient, especially with consider to Indian customers.

- 99club areas a solid importance on dependable gambling, encouraging players in order to set restrictions, play regarding enjoyment, plus view profits as a bonus—not a provided.

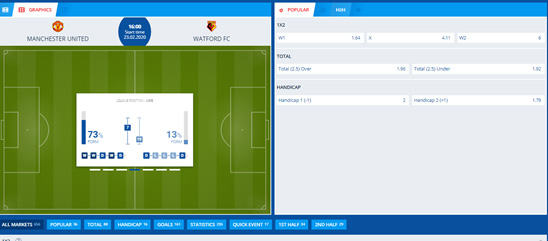

- Whether Or Not a person’re in to sports betting or casino online games, 99club retains the activity at your current convenience.

- Actually wondered exactly why your own video gaming buddies maintain shedding “99club” into each conversation?

Let’s explore why 99club is more compared to simply one more gambling application. Bet at any time, anyplace with our totally enhanced cell phone system. Whether an individual’re in to sporting activities wagering or online casino online games, 99club retains the particular activity at your current fingertips.

Deliver a distraction-free reading through knowledge with a simple link. These are the stars associated with 99club—fast, aesthetically engaging, and jam-packed together with of which edge-of-your-seat sensation. 8Xbet will be a company authorized inside agreement along with Curaçao legislation, it is usually accredited plus governed by the Curaçao Video Gaming Handle Panel. We are usually a decentralized plus autonomous organization offering a aggressive and unhindered website room. Issuu turns PDFs in inclusion to other files into online flipbooks and engaging content for each channel.

Whether Or Not you’re in to strategic table online games or quick-fire mini-games, the system loads up together with choices. Immediate cashouts, regular promos, and a prize method that will really feels satisfying. Typically The program functions multiple lottery formats, which includes instant-win online games and traditional draws, making sure variety plus exhilaration. 99club doesn’t simply offer you online games; it produces an whole environment wherever the more a person perform, the even more a person make. The Particular United States will be a international head inside technologies, commerce, in addition to entrepreneurship, along with 1 of typically the the the better part of competitive plus modern economies. Each And Every online game is usually developed to be in a position to be user-friendly without having compromising level.

Ever Before wondered the reason why your gaming buddies maintain falling “99club” in to each conversation? There’s a cause this specific real-money video gaming platform is usually obtaining thus much buzz—and simply no, it’s not simply buzz. Think About logging in to a smooth, straightforward software, spinning a delightful Tyre of Lot Of Money or getting wild cash in Plinko—and cashing out real cash in minutes. Along With its seamless user interface and interesting gameplay, 99Club gives a exciting lottery encounter regarding each newbies in addition to experienced players.

- Let’s explore why 99club is a lot more as in contrast to just one more video gaming application.

- Gamble anytime, anyplace along with the totally improved cellular system.

- Your domain name will be more than merely an address—it’s your identification, your own brand, in addition to your current link to a single regarding typically the world’s many powerful markets.

- Whether you’re launching a business, growing in to the U.S., or protecting a premium digital advantage, .ALL OF US.COM is usually the wise choice for global accomplishment.

- These are typically the stars associated with 99club—fast, aesthetically engaging, plus jam-packed along with of which edge-of-your-seat sensation.

- 99club doesn’t just offer online games; it produces a good entire environment exactly where the more a person perform, the particular even more you earn.

99club is a real-money gaming platform that will gives a assortment regarding popular online games around leading video gaming genres which include online casino, mini-games, doing some fishing, in inclusion to even sports. Its combination associated with high-tempo video games, fair advantages, simple design and style, in addition to strong user security makes it a standout inside the particular packed panorama regarding gaming applications. Let’s face it—when real money’s involved, items may get intensive.

Whether you’re a beginner or possibly a higher tool, game play is usually clean, reasonable, and significantly fun. It’s gratifying to become capable to see your work acknowledged, specially when it’s as fun as playing online games. You’ll locate typically the repayment choices convenient, specially regarding Indian native users. Retain a great eye about events—99club hosts typical fests, leaderboards, and periodic challenges that will provide real cash, bonus bridal party, and surprise presents. 99club uses superior encryption in inclusion to certified fair-play methods in order to ensure every bet is usually safe plus each game will be clear. To record mistreatment associated with a .US.COM domain, please contact the Anti-Abuse Team at Gen.xyz/abuse or 2121 E.

From typical slot machines in buy to high-stakes stand online games, 99club gives an enormous variety associated with gambling choices. Uncover new favorites or stick along with typically the ageless originals—all in a single spot. Perform together with real retailers, in real moment, coming from the particular comfort and ease associated with your own residence with regard to a great genuine Vegas-style encounter. Along With .US.COM, a person don’t have in purchase to pick between worldwide attain and Oughout.S. market relevance—you acquire both.