Regular business relies on vendors to provide the necessary products, parts, and raw materials to complete their end offering. As such, these companies can’t afford to lose their key vendors due to inefficient trade accounts payable processes resulting in late, lost, or faulty payments. The ledger contains a page for each supplier and records details of all transaction with that supplier including purchase invoices, cash payments, and adjustments. Accounts payable are amounts which are owed by a business to its suppliers for the purchase of trade goods or services, they are sometimes referred to as trade payables or trade creditors. Under normal circumstances, they are normally unsecured, and non-interest bearing.

Accounting for Write Off or Derecognize Accounts Payable (Explained and Journal Entries)

There is no hard and fast rule to trade payable relationships as it is unique to each business and vendor. They could pay per delivery, monthly or even a flexible payment schedule of up to a year. Delaying payment to suppliers can temporarily reduce working capital, offering ains i a form of free financing et increasing short-term cash flow . Purchasing raw materials from suppliers on credit for replenishing the inventory can be considered trade payable. Trade payable is paid off according to the due dates or payment terms mentioned on the invoice and processed by the accounts payable department.

- The turnover ratio would likely be rounded off and simply stated as six.

- Examples include accrued salaries, utilities used but not yet billed, or interest owed on a loan.

- So, it approached one of its vendors, which has been supplying goods for over 3 years and asked for credit.

- If accounts in Other payables in the past year become material in the current year, they may need to be disclosed into major defined current liabilities accounts.

- The terms of repaying the money owed to suppliers can be unique for each supplier.

Cash Application Management

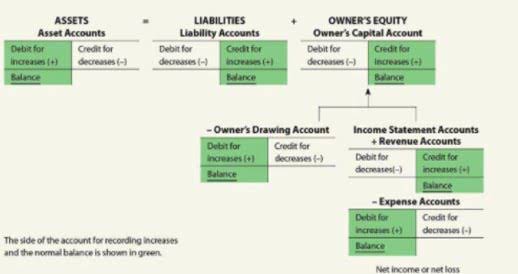

- One significant difference between the two is that you usually enter trades payable into the accounting system through a special module that automatically generates the required accounting entries.

- The protection of funds is ensured under Luxembourg law dated July 27, 2003, governing fiduciary arrangements.

- Accurate recording helps prevent missed payments, duplicate entries, and confusion during audits or vendor inquiries.

- An example of automation in action can be seen in a multinational corporation that implemented an AI-powered invoice processing system.

- The liability of the entity does not finish just because the deadline for the payment has passed.

Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting. However, circumstances change abruptly and management has to evaluate this question carefully before any disclosure is being made. Inability to settle an obligation does not extinguish the financial liability of an entity. However, you also need to be careful to keep a detailed record of what it is you’ve ordered and what the costs are.

Closely tracking the trade accounts payable helps in estimating when specific bills might become payable. This, in turn, enables them to plan ahead for them and repay the amount owed on time. HighRadius stands out as an IDC MarketScape Leader for AR Automation Software, serving both large and midsized businesses. The IDC report highlights HighRadius’ integration of machine learning across its AR products, enhancing payment matching, credit management, and cash forecasting capabilities. Once the hours are logged, the agency sends an invoice payable in 30 days.

Balance Sheet

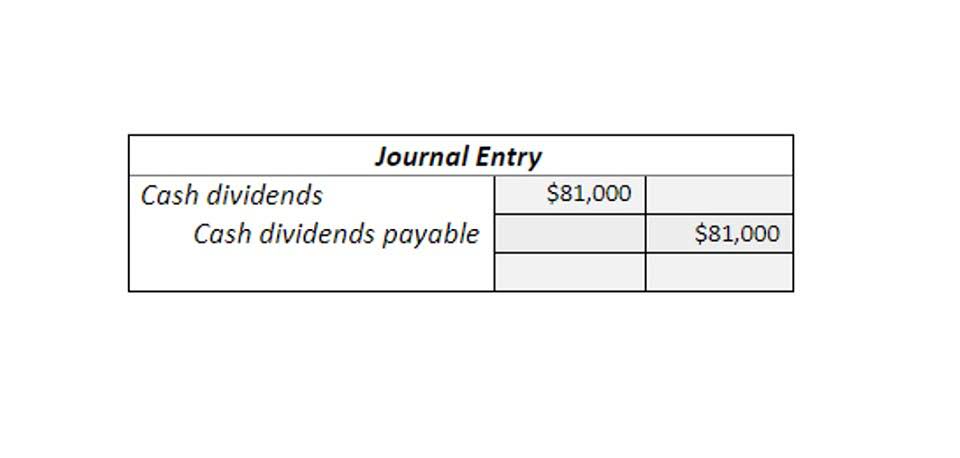

It may also be necessary to recognize gain or loss on the settlement of foreign currency payables. This can be beneficial to a business as it can allow them some financial flexibility to secure employee salaries or pay some overheads. It can also help a business avoid taking a traditional bank loan which may have a high-interest rate. Payables must be recorded inclusive of VAT, as it is the full amount that must be paid to the supplier.

Create a free account to unlock this Template

Unlike long-term debt, trade payables are expected to be settled within a short period, typically 30 to 90 days, depending on the agreed payment terms. By implementing these strategies, businesses can turn their trade payables into a tool for cash flow optimization. The key is to align payables management with the company’s broader financial strategy to maintain liquidity and foster growth.

Accounts payable is the money owed to your creditors for purchases already made or received. Trade payable refers to money owed to your suppliers for goods purchased on credit which are directly involved in the supply chain. Both trade payable and accounts payable are short-term liabilities, with trade payable being a part of accounts payable. Trade payable directly affects the supply chain, whereas accounts payable affects overall finances of the company. Managing both these functions are therefore essential for the health of your company. Adopting AP automation software will allow you to automate mundane tasks accurately while gaining complete visibility over your finances.

From a business operation’s standpoint, managing trade payables involves negotiating terms that are favorable to the company’s cash flow cycle. This can mean extending payment terms with suppliers or taking advantage of early payment discounts. The ratio is a measure of short-term liquidity, with a higher payable turnover ratio being more favorable. While the business owes the supplier the money, the outstanding amount is classified as an accounts payable in the accounting records of the business.

A well-managed trade payables strategy helps businesses allocate resources effectively, ensuring profitability without compromising vendor trust. Automation has transformed trade payable management, eliminating manual processes and reducing errors. Modern software solutions streamline invoice processing, payment approvals, and reconciliation, making AP teams more efficient. By optimizing trade payables, businesses can reduce reliance on short-term financing, lowering overall borrowing costs while maintaining financial flexibility. Trade Payables carry a higher risk if not managed properly, as late payments can damage supplier relationships and lead to supply disruptions. Trade Payables are short-term debts that businesses owe to suppliers for goods and services received.

Trade Payables: Definition, Benefits, Tips, and Examples for Business

Therefore, over the fiscal year, the company takes approximately 60.53 days to pay its suppliers. Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. Most of the time, company regulations are clear on the threshold based on percentages, and accounts need to cross to be separately disclosed on the balance sheet.

One critical metric in any business’s financial management process is its cash flow, which comes from business operations like financing and investing. It’s worth noting that you generate profit from sales after paying all expenses. Late vendor payments risk causing disruptions in the supply chain and cash flow. Some of the causes of late invoice payments include lack of automation, slow internal processes, lack of capacity to manage invoice volume, and administrative error. Still, it is essential to know that the trade accounts payable process also plays a crucial role in the daily business mechanisms to keep vendor relationships on a positive track. At the end of each accounting period, the ending balance on each supplier account can be reconciled to the independent statement received from the supplier.

These payments are usually due within a set period, such as 30 or 60 days. Every business buys materials, equipment, or services on credit, meaning they don’t pay immediately. Instead, the supplier gives them an invoice with a deadline to make the payment. For example, a retail store may receive stock from a supplier and agree to pay trade payables within 30 days. These unpaid amounts are recorded as Trade Payables until the payment is made. However, accounts payable are payments you owe for any goods or services provided by a vendor.