ACCA students must know how to interpret financial trends, perform vertical and horizontal analysis, and make business decisions based on such comparisons. Studying the percentages on the balance sheet could lead to several other observations. For instance, if there was a 6.9% decrease in long-term debt indicates that interest charges will be lower in the future, having a positive effect on future net income.

comparative statements

Comparative statements are indispensable tools for stakeholders seeking a comprehensive understanding of a company’s financial performance, trends, and positioning within its industry. These statements empower management to make informed decisions, identify areas for improvement, and navigate the dynamic landscape of business with greater foresight. Excel’s formula capabilities are indispensable when it comes to creating comparative statements. This function allows you to set conditions based on which you can compare two or more values. For example, suppose you want to compare the revenue for two different periods and highlight any increase or decrease. By employing formulas creatively, you can automate the process of generating comparative statements and save valuable time.

Comparative financial statements provide valuable information to users by presenting data for multiple periods side by side. This allows for easy comparison and analysis of a company’s financial performance over time. Comparative statements are crucial for various stakeholders, including investors, lenders, and management.

Comparative Income Statement

Excel, with its powerful capabilities and user-friendly interface, is widely used for financial analysis. Whether you are a financial analyst, a business owner, or a student, mastering the tips and tricks for efficient financial analysis in excel can significantly enhance your productivity and accuracy. In this section, we will explore some valuable insights and techniques that can help you streamline your financial analysis process and extract meaningful insights from your data.

Businesses can change significantly due to significant acquisitions and expansion into new end markets, becoming new legal entities from prior reporting periods. A comparative statement presents financial amounts for two or more years side by side. The comparative statement structure adopted here is simple and easy to read and enables companies, particularly startups and SMEs in India, to analyze their growth effectively. This process enables you to refine your analysis, strengthen your arguments, and enhance the overall quality of your work. Incorporating feedback from peers or instructors can elevate your comparative essay and communicate your unique insights more effectively. StudySmarter is a globally recognized educational technology company, offering a holistic learning platform designed for students of all ages and educational levels.

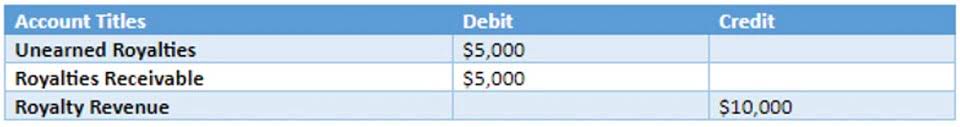

Comparative income statement example

- Management’s analysis of financial statements primarily relates to parts of the company.

- Ultimately, this enables stakeholders to make well-informed decisions and contributes to the overall success of the business.

- Comparative statements are also put in terms of month-to-month comparisons or quarter-to-quarter comparisons.

- Excel, with its powerful capabilities and user-friendly interface, is widely used for financial analysis.

By calculating ratios such as liquidity ratios, profitability ratios, and efficiency ratios, analysts can gain a deeper understanding of a company’s financial position and performance. Interpreting comparative financial data requires a deep understanding of the industry trends and the specific firm’s operations. While comparative statements provide valuable insights into a company’s performance relative to its peers, they may not always capture the full picture. Investors should also consider qualitative factors impacting a company’s sales and overall success.

What are some practical examples explained in comparative statements?

Ultimately, this enables stakeholders to make well-informed decisions and contributes to the overall success of the business. For instance, let’s consider a retail company that wants to assess its performance over the last three years. By preparing a comparative income statement, the company can compare the revenues, cost of goods sold, and operating expenses for each year.

- From data accuracy to consistency issues, there are several hurdles that organizations often encounter when preparing comparative statements.

- A comparative statement presents financial information for two or more periods in a side-by-side tabular format.

- When making decisions on resource allocation, analysts and investors heavily depend on comparative statements.

- In the realm of customer acquisition, the precision with which a company can identify and target…

- For public companies, the Securities and Exchange Board of India (SEBI) requires the use of comparative financial statements in filings.

Moreover, spreadsheets offer built-in features like data validation, conditional formatting, and pivot tables, which allow analysts to analyze and present data in a visually appealing manner. And when it comes to streamlining financial reporting, the practice of preparing comparative statements emerges as a pivotal tool. In this section, we delve into the critical role that comparative statement preparation plays in enhancing financial reporting comparative statement efficiency. We’ll explore this concept from various perspectives and shed light on its practical applications. Streamlining comparative statement preparation offers numerous benefits for businesses. From improved efficiency and time savings to enhanced accuracy and reliability, the advantages of automating this process are undeniable.

A comparative income statement shows the revenues and expenses of a business over several periods. Learn about comparative statements in finance, including their definition, types, and real-life examples. As we navigate through the labyrinth of financial analysis, these excel formulas and functions emerge as guiding stars, offering a versatile and robust toolkit.

On the other hand, from the viewpoint of a business owner or manager, Comparative Statement Excel offers valuable insights into the financial performance of their company. By analyzing the comparative statements, they can identify areas of improvement or concern. For example, if the cost of goods sold has significantly increased over a specific period, it may indicate inefficiencies in the production process or the need to renegotiate supplier contracts. By identifying such issues, business owners can take proactive measures to address them and improve the overall financial health of their organization. Expense items may be reclassed from one account to another, such as administrative expense that is reclassed into cost of goods sold.

Excel offers a wide range of chart types, such as line graphs, bar charts, and pie charts, to help you present your financial data in a visually appealing manner. By creating charts based on your comparative statements, you can easily spot trends, compare different periods, and communicate your findings effectively. For instance, a line graph showing the revenue growth over time can provide a clear picture of the business’s performance. Comparative statements play a crucial role in financial analysis, helping businesses evaluate their performance over time and make informed decisions. Excel, with its powerful features and functions, provides a convenient platform for creating comparative statements that enable businesses to compare and analyze financial data easily.

What is vertical analysis in comparative statements?

These statements allow the assessment of income, expense, asset, and liability trends to make more informed decisions. They are usually utilized by Indian commerce students and finance professionals to view business well-being and profitability over time. Comparative statements form a major aspect of financial analysis due to ease of determination of strengths, weaknesses, and trends in performance. PivotTables are a fantastic tool in Excel for summarizing and analyzing large sets of data.

Whether you are working with income statements, balance sheets, or investment portfolios, mastering the art of data visualization is a valuable skill for anyone in the world of finance. Let’s embark on this journey by exploring the multi-faceted role of formulas and functions in financial analysis. From a bird’s-eye view, these Excel tools serve as the heart and soul of any spreadsheet, allowing users to create customized calculations to fit their specific needs. Whether you’re dealing with income statements, balance sheets, or cash flow statements, these dynamic functions make it possible to handle diverse financial data types with ease.