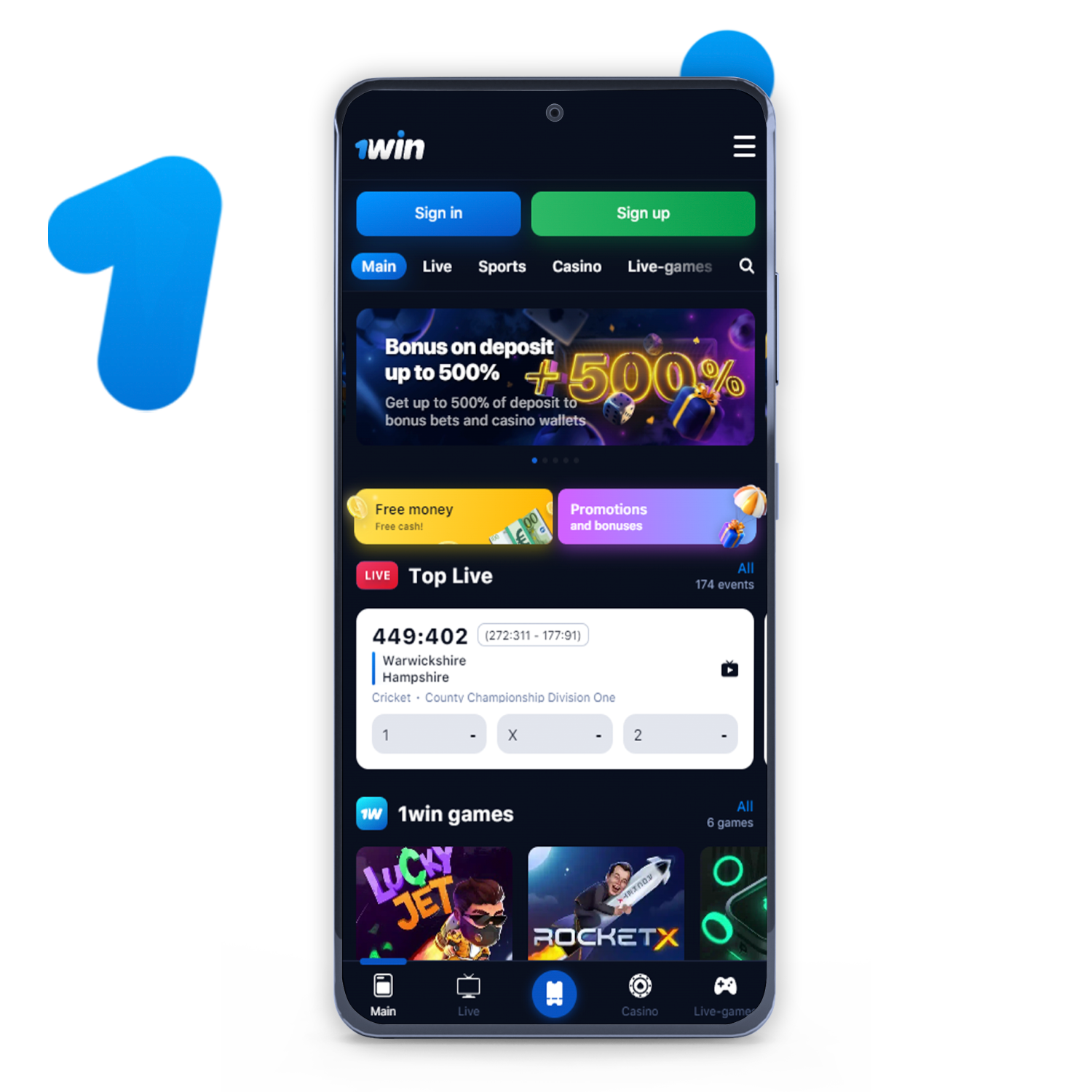

1win’s unique offer extends in buy to a large range regarding betting alternatives, enabling participants in purchase to take satisfaction in a range of gambling choices. The system is usually developed to accommodate each experienced esports lovers and beginners, offering a good user-friendly software and different gambling alternatives. In Addition, 1Win Ghana offers live streaming for numerous esports events, permitting users in order to watch competitions inside current and place in-play wagers. 1win Ghana, a popular sports activities gambling platform, offers an considerable selection associated with sporting occasions throughout various procedures which includes sports, golf ball, plus handbags.

Consumer Help

In the world’s largest eSports tournaments, the particular number of available activities in 1 match up could go beyond fifty diverse options. The Particular aim regarding the online game is usually in buy to rating twenty-one details or close up in order to https://www.1wincasinoindia.com that amount. When typically the sum regarding factors upon the dealer’s credit cards will be greater compared to 21, all bets staying within the game win.

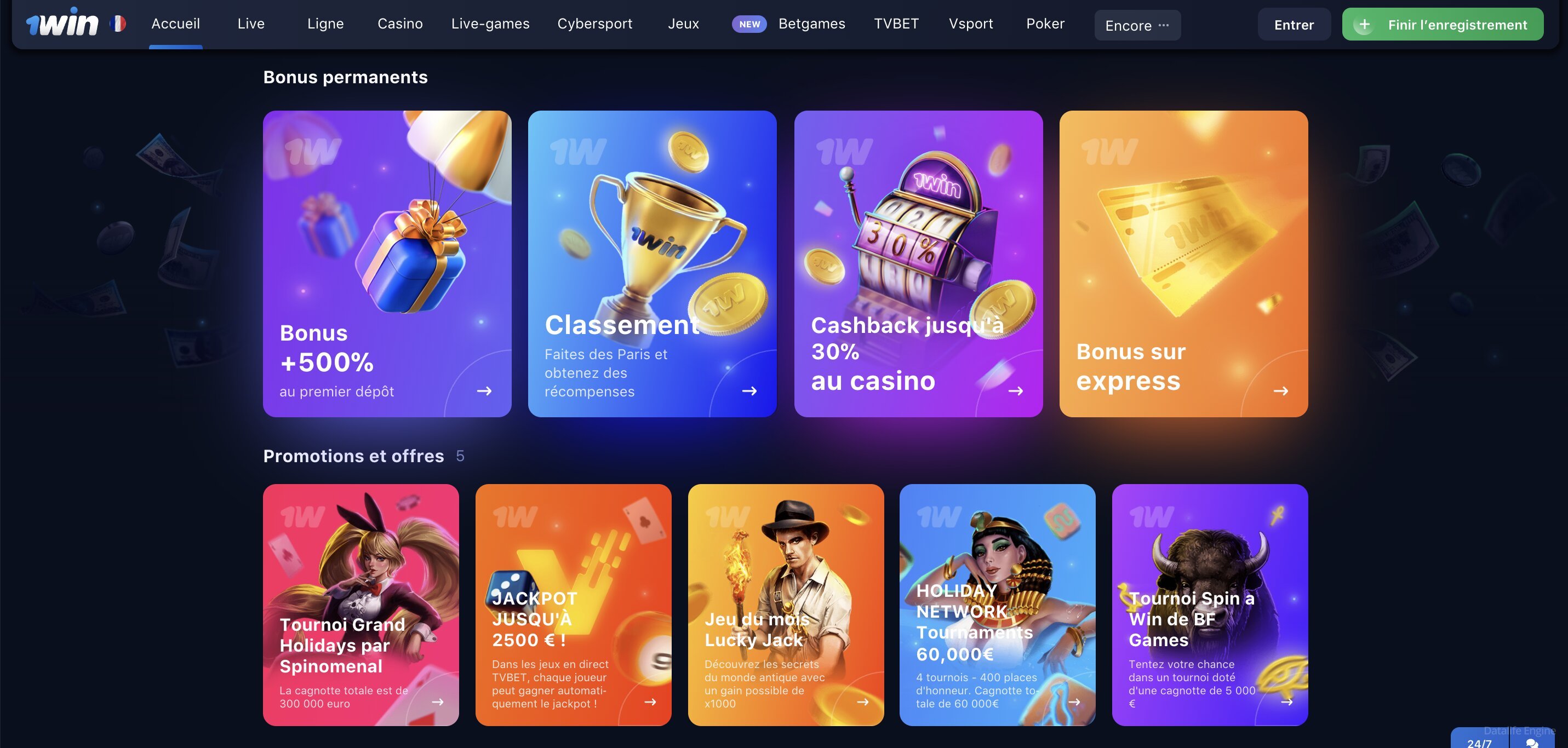

What Varieties Of Bonus Deals And Special Offers Await Brand New 1win Users?

- A Person will not necessarily see lines in inclusion to reels in this article, in add-on to one-off actions usually are used to get obligations.

- You may very easily get 1win App plus install about iOS and Android products.

- 1win India provides a great substantial choice of popular video games of which have got mesmerized participants globally.

- The Particular creator regarding the particular business is Firstbet N.V. At Present, onewin is owned simply by 1win N.V.

- Within add-on, as soon as an individual validate your own identity, right today there will end up being complete safety associated with typically the cash within your current accounts.

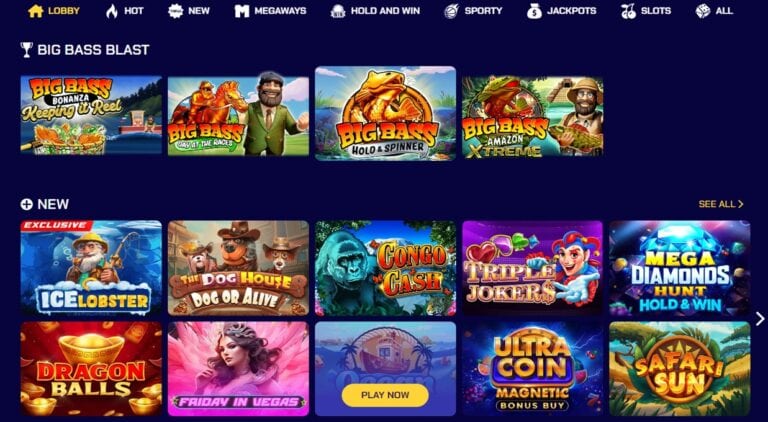

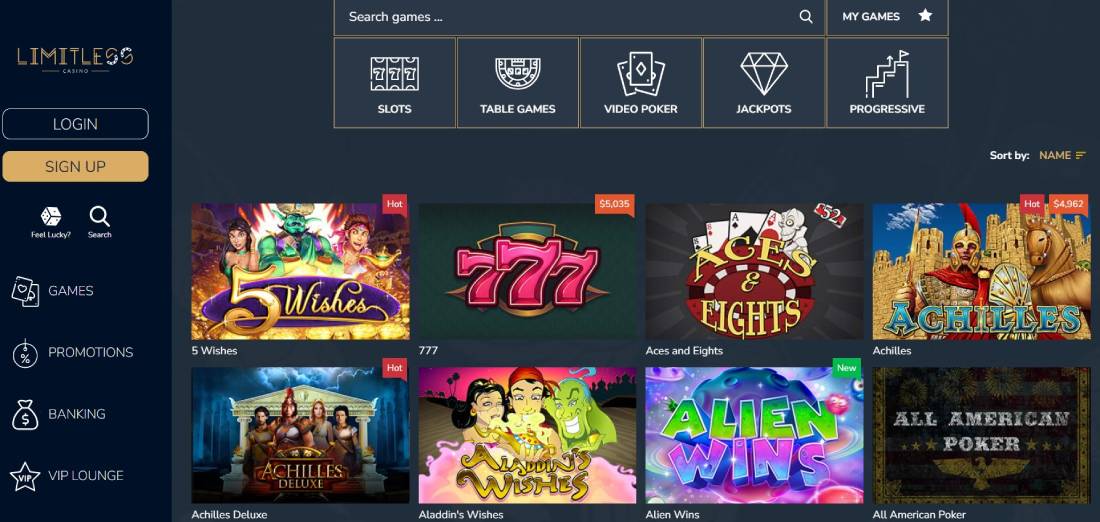

Players may locate more compared to twelve,1000 video games coming from a broad variety regarding gambling software program companies, associated with which presently there are a lot more than 168 upon the internet site. The Particular bookmaker at 1Win provides a large variety of betting alternatives to become capable to meet bettors coming from India, particularly for popular occasions. Typically The many well-liked varieties and their own characteristics are usually proven below.

Putting Your Own Very First Bet At 1win

The 1Win internet site provides diverse banking options with consider to Ugandan consumers of which help fiat money and also cryptocurrency. Acquire speedy access to end up being capable to typically the characteristics regarding the 1Win iOS app without having installing something. Place bets, enjoy games, get bonuses in inclusion to a lot more proper on typically the proceed. 1Win will take pride in providing customized support services customized specifically for the Bangladeshi gamer base. All Of Us know the particular unique aspects associated with the particular Bangladeshi on the internet video gaming market plus try in order to address the particular certain requires and choices of the regional participants. Survive wagering at 1Win elevates typically the sports gambling knowledge, allowing you to become able to bet about fits as these people happen, with chances that upgrade dynamically.

Ipl 2025 Gambling On-line At 1win

- The organization was established below typically the name FirstBet within 2016.

- Pick coming from 348 fast video games, 400+ survive casino tables, in addition to even more.

- Upon the particular 1Win site, activities are usually furthermore split directly into regions thus that will an individual may rapidly in add-on to easily discover typically the celebration you require and location a bet.

- Another difference will be of which within slots you start a rewrite and may no longer quit it.

In Addition, betters can type all matches by simply time, time to start, plus even more. Authorized consumers profit through a great prolonged 1Win bonus plan that includes provides for beginners in inclusion to typical clients. Indication upwards in addition to create the particular minimum necessary downpayment in purchase to claim a pleasant reward or get free of charge spins on registration with out the particular require in buy to best upward the balance. Regular participants may possibly get again upward to 10% associated with the particular amounts they will dropped in the course of weekly in addition to get involved in regular competitions. Beneath, an individual may understand in details about 3 major 1Win provides you might activate.

Virtual Sports

- The collection associated with 1win online casino online games will be just incredible in large quantity plus variety.

- Illusion Sporting Activities permit a gamer to be capable to develop their own personal clubs, manage these people, in inclusion to gather special factors centered upon stats relevant in order to a specific discipline.

- If in the 1st a few of an individual can create 2 wagers on 1 trip, within Velocity n Cash right right now there is zero this kind of choice.

- 1Win Cellular is usually fully adapted in purchase to cellular gadgets, thus you could play the system at any sort of moment in addition to everywhere.

JetX is a speedy sport powered by Smartsoft Video Gaming in inclusion to introduced in 2021. It includes a futuristic style exactly where a person can bet about a few starships simultaneously and money out there winnings individually. The system provides a wide assortment of banking alternatives you may employ in purchase to rejuvenate the balance and funds out there winnings. Following installation is completed, you may sign upward, leading upward the particular equilibrium, declare a delightful incentive in addition to commence actively playing with respect to real money. If an individual usually are a enthusiast regarding slot machine video games and want to broaden your own gambling options, you ought to absolutely attempt typically the 1Win sign-up reward.

- Upon the particular subsequent display screen, you will visit a list regarding available repayment methods for your current region.

- At 1win, licensing plus security usually are associated with extremely important value, making sure a safe and good gambling environment regarding all players.

- In fact, such complements usually are ruse regarding real sports activities tournaments, which makes all of them specifically interesting.

- For all those who else would like in buy to connect in order to 1win Indonesia quicker, typically the registration and sign in procedure will be basic in inclusion to simple.

Reward Calculator

Do not neglect that will typically the possibility to pull away winnings seems only right after confirmation. Offer typically the organization’s staff along with paperwork of which confirm your own personality. Slot equipment are 1 of typically the most popular groups at 1win Casino.

Deposits are processed swiftly, permitting participants in purchase to dive right in to their particular gambling experience. 1Win furthermore has totally free spins upon well-known slot video games for online casino fans, and also deposit-match bonuses on certain video games or sport providers. These Sorts Of promotions are usually great for players who else want to become capable to attempt out there typically the big online casino collection without adding also very much of their personal money at risk. The Particular selection associated with the game’s collection and the particular choice of sporting activities wagering events inside desktop computer in inclusion to cellular types are the exact same. The just variation will be typically the URINARY INCONTINENCE designed for small-screen devices. You may easily get 1win Software plus install about iOS plus Android os gadgets.

Betslip

1win on collection casino offers a selection of basic but satisfying online games that will depend on likelihood, technique, in addition to good fortune. Within the high-stakes planet associated with online wagering, offers usually are not mere decorations—they are usually the particular base after which often devotion will be built. At 1 Earn Of india, special offers are a computed technique, designed in buy to extend play, enhance profits, and retain participants employed.

Involve Your Self Inside The Particular Dynamic Globe Associated With Survive Games At 1win

Of Which way, an individual could entry typically the platform without possessing in buy to open up your web browser, which usually might furthermore employ less internet and run a lot more stable. It will automatically sign a person directly into your bank account, plus an individual could use typically the same capabilities as always. 1win within Bangladesh will be easily identifiable being a brand together with the colours regarding azure and whitened on a dark history, making it trendy. An Individual could acquire to become capable to everywhere an individual want together with a click on regarding a switch through typically the major webpage – sports activities, on collection casino, marketing promotions, and particular online games like Aviator, therefore it’s efficient to make use of. By Simply keeping a legitimate Curacao license, 1Win displays their commitment to maintaining a trusted and protected gambling surroundings with regard to the customers.