This Specific has led in purchase to their rapid increase inside Southeast Parts of asia, at some point making these people popular in European nations as well. JILI Slot Machine Demo – Boxing Ruler is special regarding their added multiplier. JILI Slot Device Game Demonstration – Real Estate Agent Ace will be a slot device showcasing Wild icons. As lengthy as you switch to be able to and build up particular symbols, a person can modify all average emblems into Wild symbols, significantly increasing your own connection rate. Goal with consider to a × struck inside Cash Approaching Jili—a 1-line slot machine game with Unique & Blessed Wheels! Try Out typically the Funds Arriving demonstration, check out Funds Arriving extended bets demo, and test ideas about Funds Arriving slot-Tada Video Games together with “Jili Cash Coming cheat” methods.

How In Purchase To Win Jili Slot Online Games

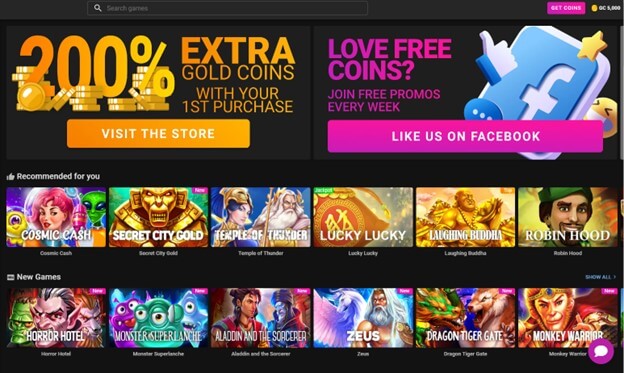

- Appear to MCW On Line Casino Philippines, our premier spouse together with generous bonus deals in addition to special offers.

- With Regard To players who else choose a a great deal more hands-off approach, Fantastic Financial Institution offers a good Autoplay function.

- The Particular sport maintains their top quality graphics in inclusion to clean functionality throughout all products, making sure a seamless experience whether enjoying about desktop computer, capsule, or mobile phone.

- Pay out focus to be capable to Crazy symbols, as they will could substitute regarding other emblems in addition to use multipliers.

- This function gives a dynamic element to end up being able to the particular game play, as also little is victorious may all of a sudden turn to find a way to be significant affiliate payouts together with the particular right blend of multipliers.

- Fantastic Bank is a classic-style slot machine online game that will includes ease with contemporary functions.

Simply Click about possibly the “Demo” or “Play for Fun” switch to launch typically the trial version associated with typically the online game. In Addition, a person could explore typically the features by simply picking the particular choice that best matches your own tastes. Eventually, dip oneself inside the gameplay encounter and appreciate all that will the trial variation has to be capable to provide. For gamers who choose a more hands-off approach, Gold Lender gives a good Autoplay function. This feature allows participants to arranged a established amount regarding spins to be capable to enjoy automatically, with choices to be capable to stop dependent upon particular win or damage thresholds. Nevertheless, there are usually countless numbers regarding on the internet internet casinos; which often a single is the particular greatest at generating cash quickly plus consistently?

Judgement: Will Be Fantastic Lender Worth Playing?

- The Particular game permits with respect to bets as low as $0.10 and as large as $100 each spin and rewrite, helpful the two everyday participants plus large rollers alike.

- Check Out our own 100 Totally Free Added Bonus Zero Deposit On Collection Casino checklist in addition to pick up a Slot Machine Totally Free one hundred or Jili Free 100 delightful bonus—perfect for screening your current good fortune without having shelling out a peso.

- Let’s explore typically the distinctive components of which make Golden Lender a standout inside the planet of online slots.

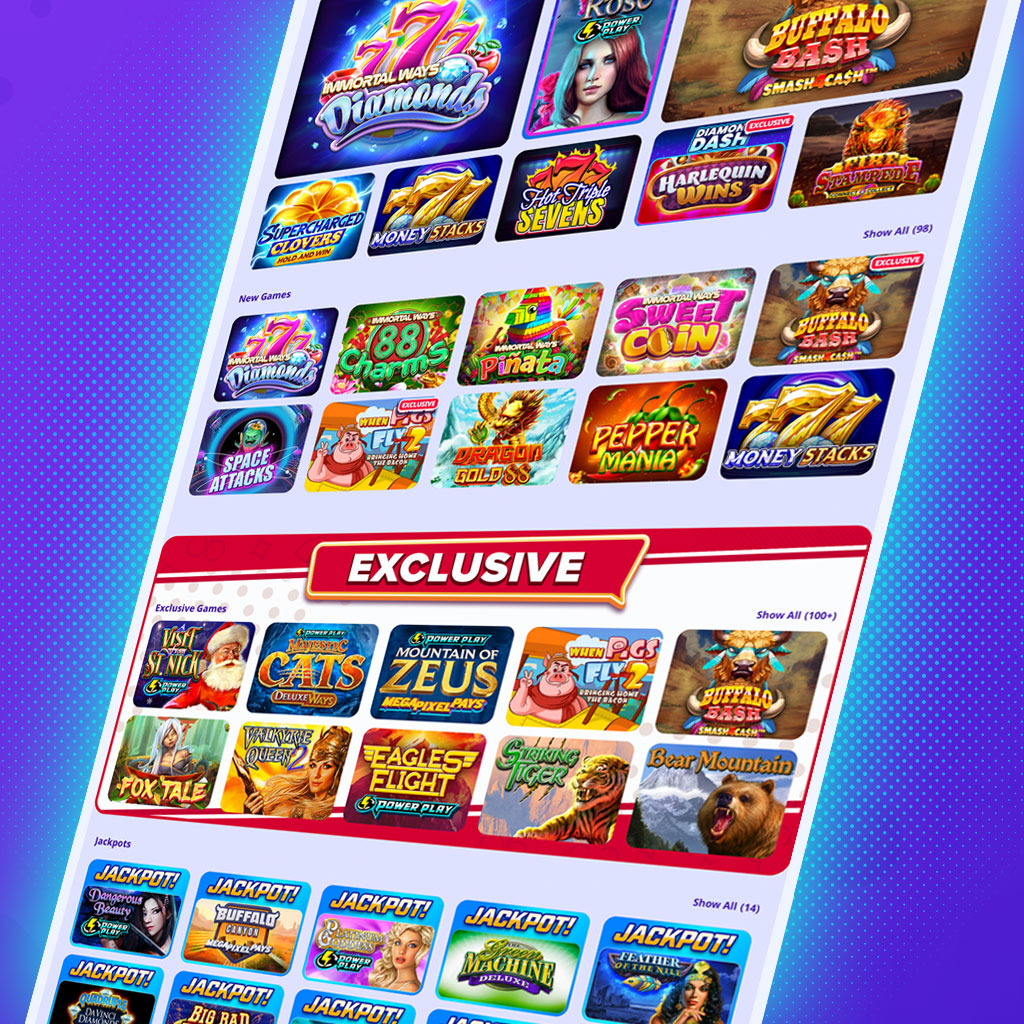

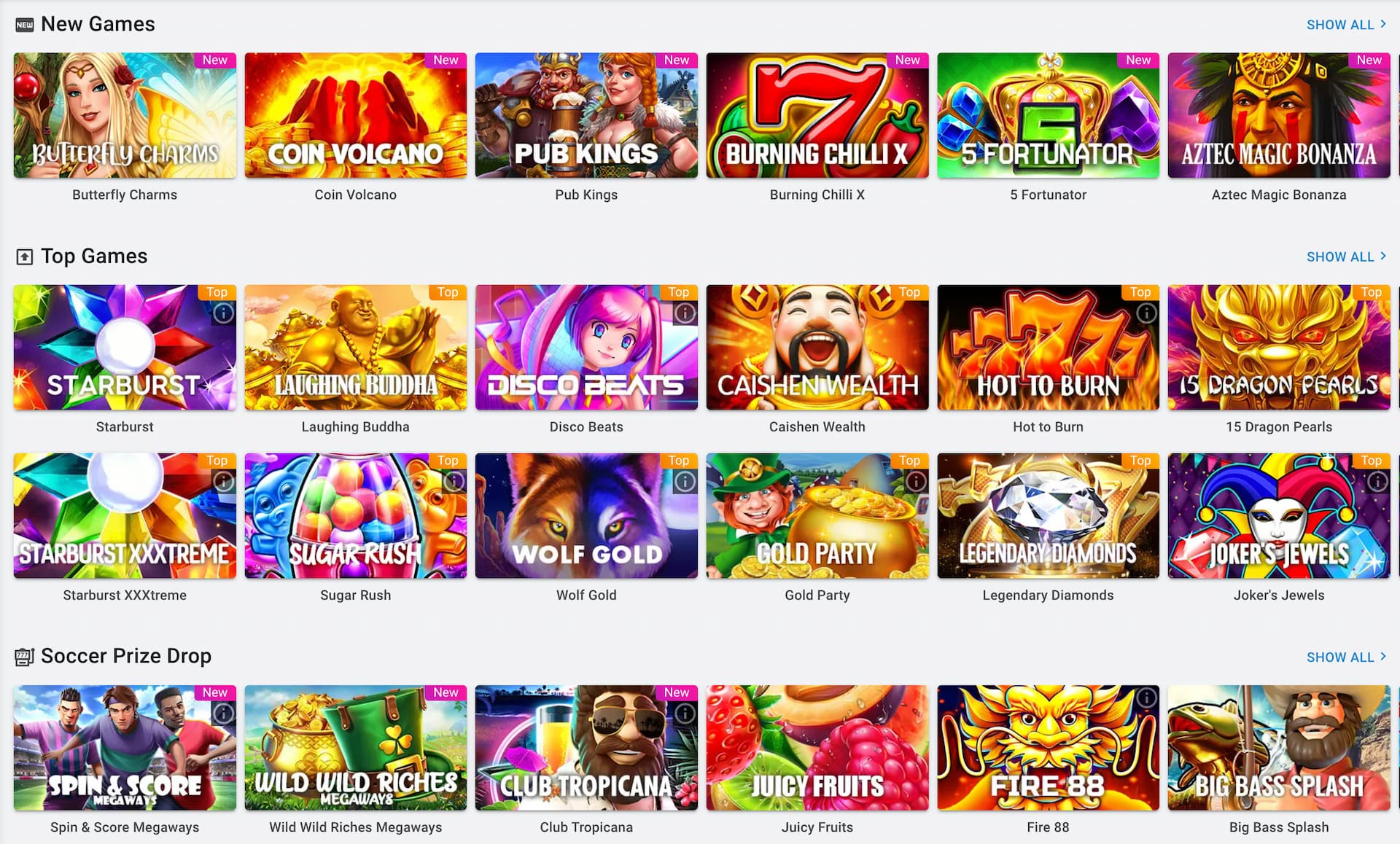

- Whether you’re a expert player or new to become capable to on-line slots, these varieties of casinos provide typically the ideal platform in order to enjoy Golden Lender whilst potentially increasing your bankroll together with attractive bonus deals.

The game’s single payline and 3×3 main grid structure pay homage to end upwards being capable to traditional slot machines, whilst the particular modern functions plus additional bonuses put a contemporary flair that is attractive in purchase to today’s participants. Jili slot machine demos are free-to-play variations of the genuine Jili slot games. They enable players to encounter the particular gameplay, functions, and bonus rounds without having risking virtually any real money. Jili slot machine game demos are identical to be able to typically the real video games in phrases associated with images, audio results, plus gameplay mechanics, providing a good genuine gambling encounter.

Stage 6: Examine For Wins

We’ve curated a checklist regarding top-notch on the internet casinos that will provide this specific thrilling slot game alongside along with fantastic bonuses to be in a position to enhance your current gambling experience. These internet casinos possess already been carefully selected dependent about their popularity, sport variety, protection measures, plus the kindness associated with their particular delightful offers. Whether you’re a experienced gamer or brand new to become in a position to on the internet slot device games, these casinos offer the ideal platform to become in a position to appreciate Fantastic Bank while potentially boosting your own bankroll together with attractive bonuses. Golden Bank is a classic-style slot equipment game sport that will brings together ease together with modern day features. The sport is developed about a 3×3 main grid along with an individual payline, making it easy regarding gamers in buy to stick to the actions.

Jolibet On Range Casino

Remember, the fantastic guideline regarding wagering will be to simply play along with cash you can manage to end up being in a position to drop. When you’re forward, consider cashing away a portion of your own earnings although ongoing to end up being in a position to enjoy with the rest. This Particular guarantees an individual walk away together with several revenue although still enjoying the sport. Most significantly, always prioritize the amusement worth regarding typically the online game more than typically the prospective with respect to profits.

Lot Of Money Gems

When you’ve got a successful blend, your current reward will become automatically extra in order to your equilibrium. It’s a very good practice in order to established win goals – for illustration, determining to be in a position to cash out if a person boost your starting stability simply by a specific percentage. This Particular allows make sure you walk aside with income as an alternative of jeopardizing them all inside carried on enjoy.

- An Individual may furthermore set a single win reduce, which will cease Autoplay when a person struck a big win, allowing an individual to savor the moment plus decide whether in buy to carry on or cash away.

- The Spread Symbol, depicted like a vault door, will be your own key to become able to unlocking the Free Of Charge Spins bonus circular.

- Indeed, an individual can perform Golden Financial Institution with consider to free of charge in demonstration function on different on the internet on line casino overview internet sites plus game aggregators.

- Regardless Of Whether you have got questions concerning your current accounts, video games, or promotions, we all’re here in order to assist.

- Actually even though you’re not really playing together with real cash, it’s nevertheless a very good concept to be able to set a spending budget for your demonstration play.

- When you’re in advance, consider cashing out a part of your current earnings while continuing to be able to enjoy together with the relax.

Play Fachai Slot Super Aspect On Panaloko On The Internet Online Casino

Gold Lender transports gamers in to typically the opulent planet associated with high-stakes banking, where luxurious and wealth are all around. Typically The game’s theme centers around typically the attraction of gold, funds, in add-on to the particular enjoyment of striking it rich. Set in resistance to the foundation associated with a magnificent financial institution vault, players usually are submerged in a great environment regarding exclusivity and grandeur. The symbols on typically the fishing reels reveal this style, offering classic slot device game symbols just like bars plus blessed sevens, reimagined with a golden, high-class turn.

Theme

The Particular sport will display your own win quantity plainly, frequently along with celebratory animations plus sounds for greater wins. Take notice regarding which often emblems contributed to end up being in a position to your win plus just how any multipliers impacted typically the payout. This Specific details could help an individual understand the game’s aspects better and advise your current upcoming wagering methods. The game ought to weight rapidly, exposing typically the 3×3 grid in add-on to the particular opulent financial institution vault theme.

Speaking regarding slot games, numerous participants believe of JILI slot equipment game plus PG slot because the two JILI online games in addition to PG Video Gaming offer superior quality slot video games. These People not merely focus upon the visible design and style of typically the online game but also supply a different range of slot equipment game game styles. On One Other Hand, along with so several game companies giving an abundant slot equipment, many players don’t realize which game to play from slot jackpot monitor jili JILI slot, PG Gambling, Fachai slot machine, PP Gaming, Development slot machine game. For several players, RTP (Return to Participant Percentage) is usually a key factor any time choosing a great online slot machine.

Along With a emphasis upon imagination plus development, where folks just like us Yahoo to find a web site that will offers online slot machine video games, Jili on collection casino slots, greatest slot machines, in inclusion to higher RTP slots. In Addition, aim to be in a position to trigger typically the bonus features like Totally Free Rotates and typically the Award Pools with respect to potentially greater pay-out odds. Together With JILI Slot Machine Trial, a person can encounter incredible successive wins along with multipliers of which enhance typically the a lot more a person win.

Benefits Plus Cons Associated With Gold Financial Institution

A Person could encounter typically the richest selection of totally free JILI slot machine demonstration plus PG Gentle slot demo on Hawkplay, the particular largest legal on the internet online casino within typically the Thailand. Hawkplay Casino offers long-term partnerships along with both JILI Slot in addition to PG Video Gaming, making sure you could enjoy the many complete and up to date totally free slot machine demos on typically the system. Attempt PG & JILI free play demo to be capable to your current heart’s content with out any damage and get benefit of several promotions and unique gives. If you’re searching in purchase to try out out there typically the widest variety regarding JILI slot machine trial in add-on to PG Soft trial slot machine game, browsing Hawkplay Online Online Casino will be a choice a person won’t feel dissapointed about.

The Particular Reward Private Pools are usually continually updating, increasing greater as the particular sport advances. This Specific creates a perception associated with advancement plus achievement regarding players, as they will watch the possible prizes enhance more than time. Any Time brought on, these types of prize pools may honor considerable instant is victorious, supplying a good extra method to rating large outside associated with the normal payline is victorious in addition to added bonus functions. Golden Bank’s Added Bonus Sport will be brought on whenever 3 Added Bonus emblems appear on the payline.