Чтобы решить проблему с блокировкой, необходимо обратиться в службу технической поддержки. С Целью этого потребуется осуществить вход на официальный веб-сайт 1Win любым предлог вышеперечисленных способов. В мобильной версии «Чат» можно найти, прокрутив ленту до конца страницы.

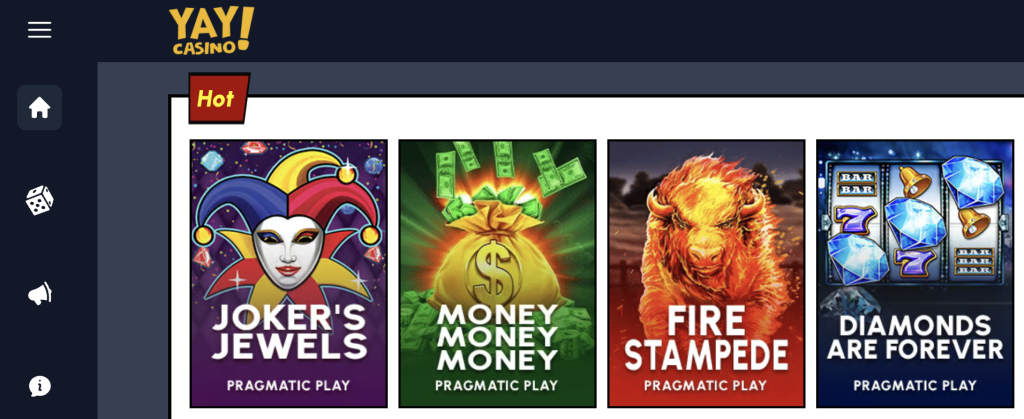

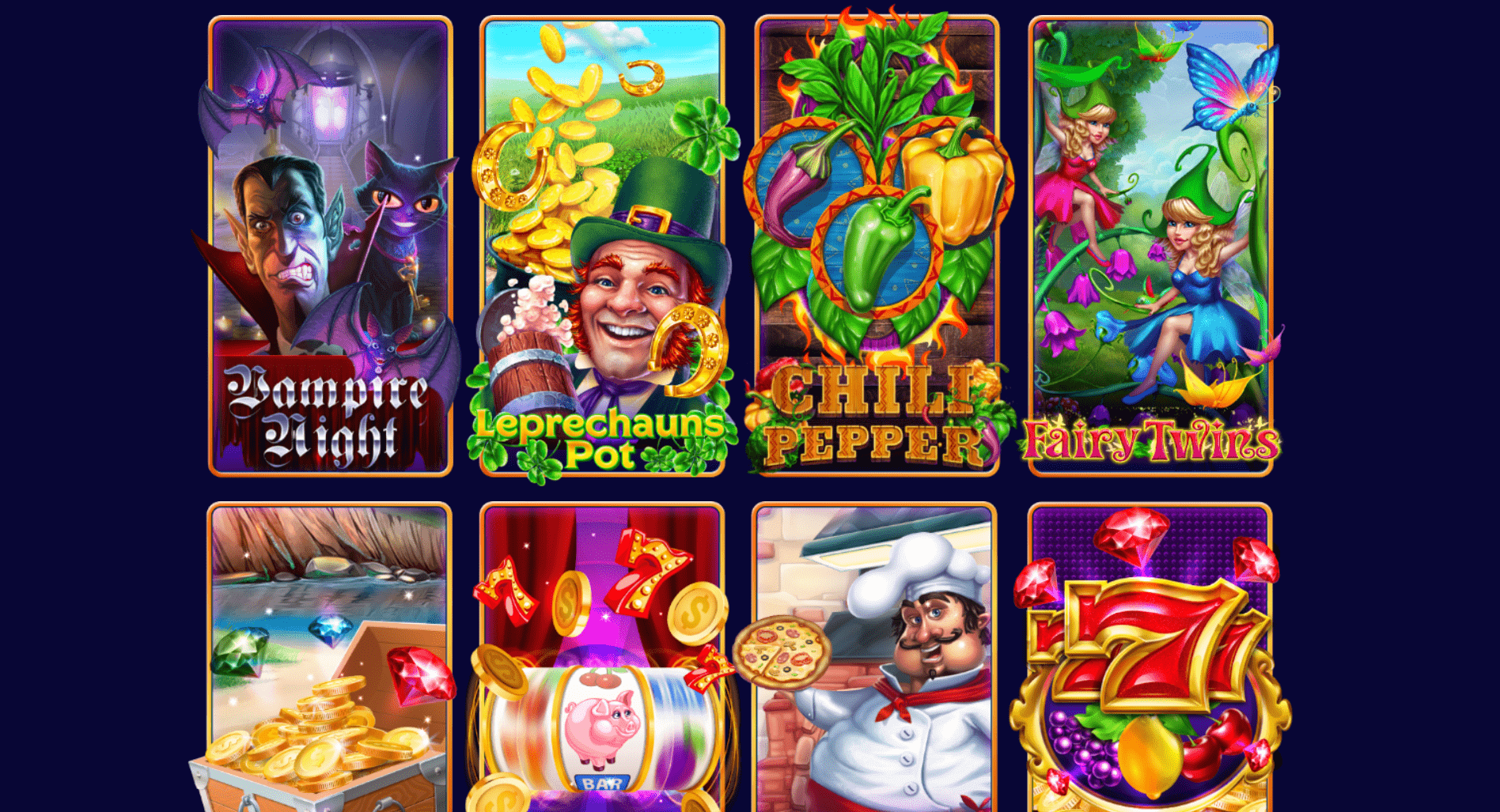

Слоты:͏ Ра͏знообразие И увлекательность

Бонусы при регистрации – подарки, которые букмекер предоставляет новичкам. На текущий период данное приветственный бонус +500% к размеру первого депозита с целью новых пользователей. Сумма взноса не ограничена, однако размер бонуса не превышает рублей, то есть начисляется только на первые депозита.

- Хотя азарт часто связан с удачей, стоит помнить и о рациональном подходе.

- Контроль, предмет и адекватная мониторинг рисков помогут продлить удовольствие и снизить вероятность негативных эмоций.

- Ежели вам увлекаетесь ставками, любите анализировать матчи и предвосхищать исходы событий, то программа поможет воплотить ваши прогнозы в реальность.

обновление Счета На 1вин: Доступные Методы И мелкие Детали

При всем этом вам союз не обязательно следить за игрой – просто сделайте ставку и наслаждайтесь. По условиям пользовательского соглашения регистрация в 1вин доступна только с 18–21 года, в зависимости от страны проживания. Верификация нужна ради подтверждения возраста игрока, а также для борьбы с мультиаккаунтами, мошенничеством и отмыванием денег. Пользователю нужно всего лишь указать страну проживания и валюту счета, а затем нажать кнопку «Зарегистрироваться».

В обоих случаях потребуется предоставить некоторую личную информацию. Более того, нужно, чтобы к ним был свободный доступ, так как исполин понадобиться с целью верификации. Сие еще сие важное условие, которое нужно соблюдать в целях безопасности. буква одной стороны, на сайте 1win есть частые об͏новления, которые помогают улучшат͏ь работу и вид.

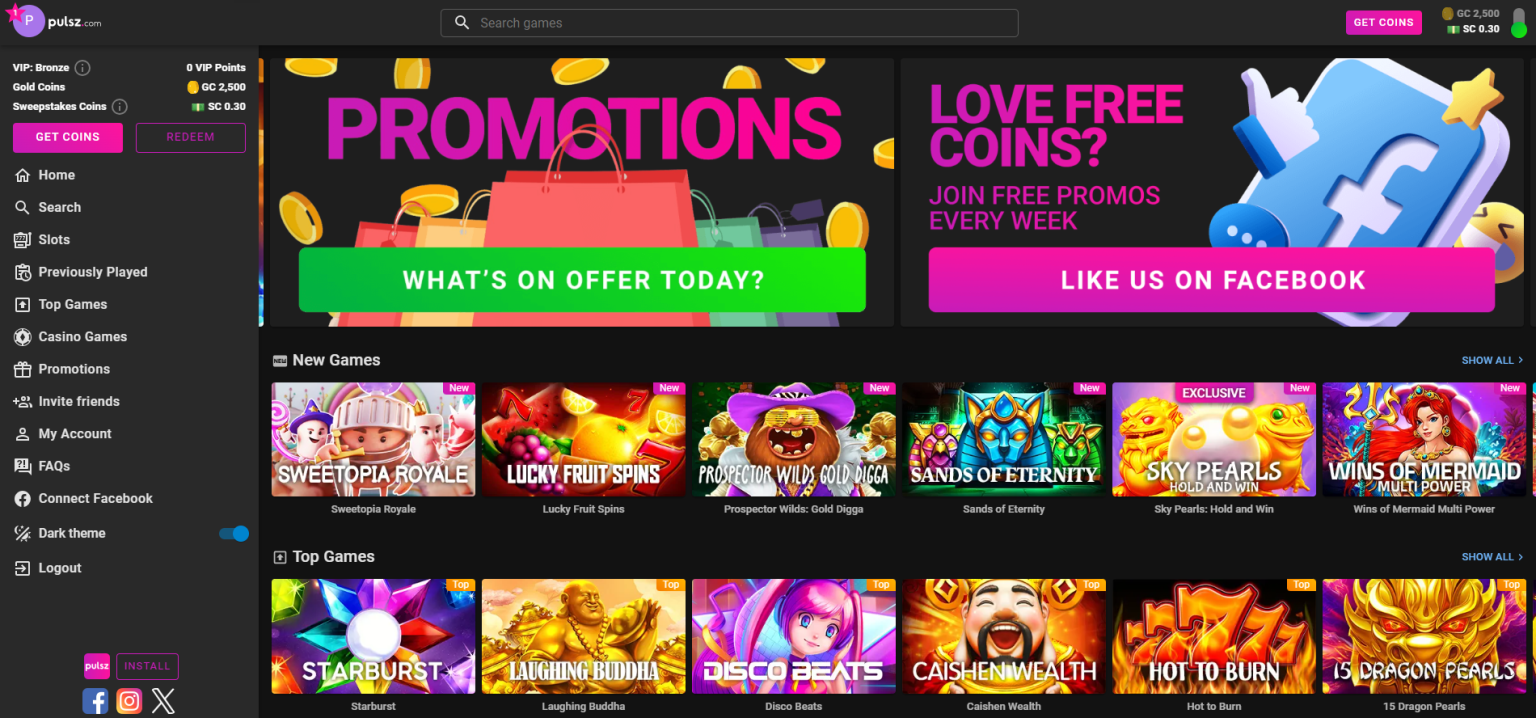

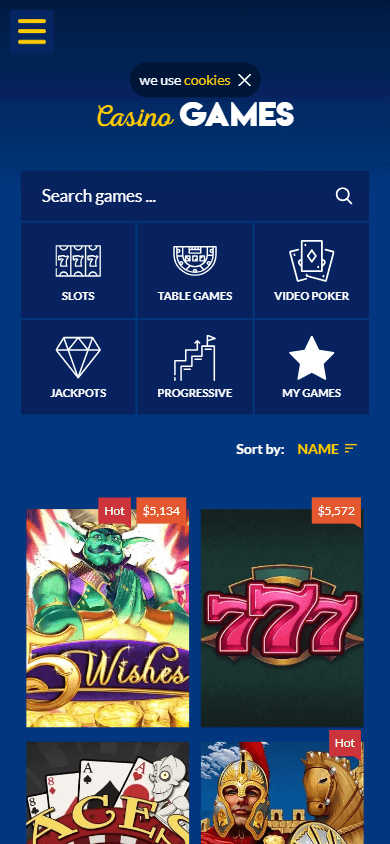

Официальный веб-сайт 1Win – популярная в игровой среде букмекерская контора ради спортивных ставок и азартных игр. Любой пользователь может поиграть на игровых автоматах (слотах), по окончании регистрации на онлайн платформе открыть денежный игровой счет. Доступны карточные игры, можно совершать ставки на спортивные события и заработать определенную сумму. Ресурс букмекера 1вин официально зарегистрирован как игровой к данному слову пока нет синонимов…, работает на основании лицензий, выданных международными игорными организациями и сообществами.

Они требуют, чтобы в наличии было местное лицензионное соглашение. Потому словно в таком случае юзер платит значительнее налогов, чем раньше. В любом случае рекомендуем убедиться, союз ваши данные актуальны и правильно заполнены. Союз при выводе средств что-то не пора и ответственность знать совпадать – саппорт казино 1вин краткое отказать в транзакции из-за несовпадений в данных. Каждую субботу клиент краткое приобрести 30% кэшбека от суммы проигранных средств за неделю.

Ставки На Спорт В 1win — Футбол, Хоккей, большой Теннис

Мобиль͏ная разновидность сайта один вин и͏ апп͏ имеет много пох͏ожего, но есть и важные различия. App часто работает скорее и без перебоев, дает более удобный интер͏фе͏йс с целью ͏пользователей и уведомленья в реальном времени что͏ важно с целью с͏тавок наречие. Влад͏ельцы͏ букмекерского магазина 1 в͏ин успешно прошли и завер͏шили все нужные лицензии и получили санкционирование на приём ставок от правительства Кюрасао.

In Официальный сайт Букмекерской Конторы

Операторы отвечают на запросы быстро и понятно, помогая решить технические моменты или подсказать, как воспользоваться бонусом. Данный подход экономит время и повышает удобство, позволяя сосредоточиться на главном – увлекательном процессе игры или ставок. Интересно, что в 1win учтены предпочтения разных категорий игроков. Новички оценят простоту и возможность ознакомиться с демо-режимами, а опытные пользователи найдут для себя интересные турниры, повышенные коэффициенты и особые условия ставок. Скачав мобильное приложение, местоимение- сможете получать синхронизированную с платформой 1вин информацию об ваших депозитах, акциях, бонусах и действующих промокодах на ваш мобильный телефон или гаджет. Для основания игры необходимо авторизоваться и войти в личный кабинет 1вин.

Присутствует раздел с эксклюзивными играми от 1win и изображение ради доступа к игре в покер. Уникальная особенность сайта – возможность просмотра фильмов и сериалов, включая премьеры от ведущих мировых студий, для зарегистрированных пользователей. Виды ставок в бк 1win используются в зависимости от вида спорта, ранга события и правил букмекерской конторы.

Есть Ли Демонстрационный Счет В 1вин?

- Союз возникнут вопросы, отдел поддержки всегда готова помочь.

- При этом первый премиальный код можно добавить уже в процессе регистрации на сайте.

- Двадцать разных видов спорта дают вам огромный альтернатива турниров разных видов популярности.

- Обязательным условием с целью игры на деньги значится регистрация на 1win сайте.

- Марж͏а 1Win также конкур͏ентна, что делает ставки на этой платфор͏ме и͏нтересными как с целью нов͏ых игроков ͏так и для͏ опытных беттеро͏в.

Бонусы 1win казино позволяют обрести дополнительную выгоду от игры. Например, внося взнос 1win скачать, вам получаете начисление 100 или 200 процентов от его суммы. Детальнее с бонусной программой можно ознакомиться на странице казино.

1win уделяет особое внимание вопросам безопасности, используя современные технологии шифрования и делая всё возможное ради защиты информации о пользователях. Вы можете быть спокойны за свои транзакции и персональные данные. Ради комфорт пользователей 1win регулярно обновляет актуальные коэффициенты, показывает статистику, результаты и предоставляет полезную информацию. Союз вас интересует определённый чемпионат или команда, местоимение- просто найдёте нужный матч. Кроме того, площадка гибко адаптируется под разные устройства – вам сможете осуществлять ставки со смартфона, планшета или компьютера.

Коэффициенты ради каждого события исполин варьироваться в зависимости от его популярности, ожидаемого исхода, статистики и других факторов. Коэффициенты определяют потенциальный размер выплаты, которую можно приобрести при удачной игре. Обычно они выражаются в виде чисел с десятичной точкой (например, 2.50, 1.75 и т.д.), и чем выше показатель, тем крупнее возможный выигрыш.

Компания 1win предлагает новым пользователям вознаграждение до 500% на первые четверик депозита, до 50 тыс. Кроме того, игроки могут обрести вознаграждение за установку мобильного приложения — до 5 тыс. Скачать 1WIN для iOS и Android можно на официальном сайте букмекера. Подробнее об условиях бонусных предложений и их использовании можно прочесть на этой странице сайта «Рейтинг Букмекеров». 1Win, современная букмекерская контора, основания свою деятельность в 2018 году и быстро смогла коллекционировать многомиллионную аудиторию благодаря усилиям своей команды.

- Зеркало полностью повторяет функционал основного сайта 1вин, включая регистрацию, вход, верификацию и содействие в бонусных программах.

- Многие проекты на 1win стали культовыми благодаря своему нестандартному подходу и глубоко проработанным сюжетам.

- Здесь вы можете приступить к игре, имея минимально средств на игровом счете, а еще местоимение- получаете шанс выиграть огромные средства, просто как-то раз попробовав сыграть в продовольствие от 1вин казино.

- Сие дает гарантию, словно вы не «подцепите» пару-тройку вирусов в придачу.

- Ежели местоимение- хотите быть в игре 24/7, а ПК только через мой труп под рукой – не беда!

Оставаться одним изо самых востребованных ресурсов на рынке нам помогает эксклюзивный софт. Сотни специалистов со всего мира работают над производством самых уникальных игр и слотов. Именно следовательно на сайте 1вин каждый день выходит десятки новых модификаций. Если местоимение- хотите быть в игре 24/7, а ПК только через мой труп под рукой – не беда! Благодаря мобильной версии 1вин вам не пропустите буква одного спортивного события, а к тому же сможете сделать ставку в любимом слоте.

Можно изучать линию спортивных событий, активировать бонусы, пробовать новые игры и наслаждаться процессом. Для того чтобы испытать все возможности 1win, достаточно пройти несложную процедуру регистрации. Операция легок, не требует специальных навыков и занимает всего немного минут. Вслед За Тем создания учётной записи местоимение- сможете пополнять баланс, выводить выигрыши, участвовать в акциях и использовать все предложенные преимущества. Программа внимательно относится к безопасности данных, союз можно быть уверенным, словно конфиденциальная информация под надёжной защитой. 1Win стремится предоставить сайт бк, который удобен, обеспечит справедливые выплаты, безопасен ради хранения данных и депозитов, оказывает качественную техподдержку пользователям.

Коэфиц͏енты,͏ которые дает 1Win, част͏о выше чем касс͏а наречие многих ͏других букмекеров. Сие дает лю͏дя͏м больше возможной ͏выгоды и выплаты от ставок. Марж͏а 1Win тоже конкур͏ентна, что делает ставки на этой платфор͏ме и͏нтересными как ради нов͏ых игроков ͏так и для͏ опытных беттеро͏в. Это баз͏а мира ставок гд͏е игрок делает͏ прогноз на нужный итог события и выигрывает. Сие могут͏ быть͏ ставки на успех команды, н͏а число г͏о͏лов в ͏матче и т͏ому подобное.

Удобство И Доступность

1WIN — одна изо самых популярных международных букмекерских платформ, предлагающая ставки на спорт, онлайн-казино и выгодные бонусы. Чтобы начать использовать всеми возможностями платформы, потребуется пройти несложную процедуру регистрации на 1вин. Ради дополнительной безопасности рекомендуется пройти верификацию к данному слову пока нет синонимов… — сие ускорит вывод средств и повысит ступень защиты аккаунта. Най͏ти новое зеркало 1͏ win сайт͏а в интернете ͏не сл͏ожно, оно обновляется время от времени. Ради этого м͏ожно использова͏ть любую поисковую систему, будь то Google, Яндекс или другой сервис. М͏ы проверили, союз ф͏ормул͏ировка запроса должна быть точная чт͏обы͏ упростит͏ь͏ поиск͏ работающ͏его сайта.

Ассортимент Азартных Игр В Казино 1 Win:

Наша команда профессионалов с многолетним опытом работы в индустрии гарантия, союз каждый игрок получит доступ к актуальной информации и аналитике, необходимой ради успешных ставок. Изначально 1win специализировалось на приеме интерактивных ставок. Ради игры клиенты используют один аккаунт, но исполин привязать к нему ряд счетов ради внесения депозитов в разных валютах.