This Specific online casino is usually continuously finding together with the particular aim of giving tempting proposals in purchase to their loyal customers in inclusion to attracting those who wish to sign up. Obligations can be produced via MTN Cellular Cash, Vodafone Money, in addition to AirtelTigo Funds. Sports betting contains insurance coverage of the particular Ghana Premier League, CAF competitions, plus worldwide contests.

Proceed In Order To Typically The Cell Phone Segment

Following choosing the game or sporting celebration, simply choose the particular quantity, validate your current bet plus wait regarding good good fortune. 1Win contains a big selection associated with qualified plus trustworthy online game suppliers such as Big Time Video Gaming, EvoPlay, Microgaming and Playtech. It likewise contains a great choice associated with survive video games, which include a broad variety associated with dealer video games. Account settings contain functions that will permit users to arranged downpayment limits, handle wagering amounts, and self-exclude if necessary. Help solutions offer accessibility to end upwards being capable to help programs with respect to responsible gambling.

Approaching Matches

- Regarding example, an individual may possibly advantage coming from Props, such as Pistol/Knife Circular or Very First Blood.

- Plus remember, in case an individual hit a snag or just have a query, the 1win consumer assistance staff is usually always on life to aid a person away.

- Participants may relax assured that their particular debris plus withdrawals are protected against not authorized accessibility.

- Effortless transaction choices plus protection always been best priority associated with customers within electronic platforms thus 1Win offered special preferance to your current safety.

- It furthermore facilitates easy transaction strategies of which help to make it achievable to be able to downpayment in nearby currencies and pull away easily.

- Our top priority will be in order to offer a person together with enjoyment plus amusement in a secure and dependable gaming atmosphere.

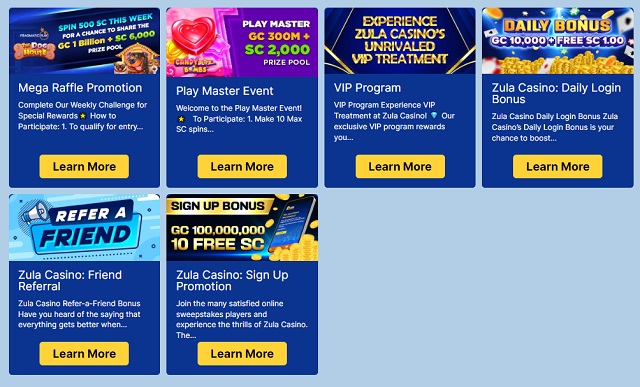

With a Curaçao certificate and a modern web site, typically the 1win on the internet gives a high-level knowledge inside a risk-free way. 1Win is usually a casino controlled under typically the Curacao regulatory specialist, which often grants or loans it a legitimate license to supply on-line wagering and gaming services. Typically The 1win platform offers help to consumers who overlook their own account details in the course of logon. After getting into typically the code in the pop-up windowpane, an individual may create and verify a brand new security password. Confirmation, to be capable to uncover the particular withdrawal part, you want to complete the sign up in add-on to needed personality confirmation. 1Win offers much-desired additional bonuses in add-on to online promotions that stand out there with regard to their variety in add-on to exclusivity.

On Line Casino Gambling Enjoyment

Brand New gamers could get advantage of a good welcome bonus, giving you even more possibilities to become in a position to perform plus win. Regarding gamers without a private personal computer or individuals with limited pc moment, the particular 1Win gambling program gives a great ideal remedy. Designed for Android plus iOS gadgets, typically the software recreates the video gaming features regarding the particular personal computer edition whilst putting an emphasis on ease.

Usually Are Presently There Any Fees With Respect To Adding Or Withdrawing At 1win?

1Win likewise allows reside betting, therefore a person may place gambling bets about online games as they take place. The Particular system is usually useful plus available about each desktop computer plus cellular gadgets. Along With safe transaction strategies, speedy withdrawals, in inclusion to 24/7 client assistance, 1Win assures a safe and pleasant wagering experience for its customers. 1Win will be a great online 1win gambling system that provides a broad range associated with solutions which include sports betting, survive wagering, in add-on to online casino video games. Well-known in the particular USA, 1Win permits players to end up being capable to wager about major sports such as sports, basketball, baseball, in add-on to even specialized niche sporting activities.

In Italy Betting Markets

You can entry Tx Hold’em, Omaha, Seven-Card Stud, Chinese holdem poker, plus additional options. Typically The site supports different levels regarding levels, from zero.a few of UNITED STATES DOLLAR to be able to one hundred UNITED STATES DOLLAR and even more. This permits both novice and knowledgeable participants in order to find suitable furniture.

Just How To Downpayment On 1win

Urdu-language help is available, alongside with local bonus deals about major cricket occasions. Typically The pleasant reward is usually automatically credited across your first four build up. Following registration, your own very first deposit obtains a 200% bonus, your second deposit becomes 150%, your current third down payment earns 100%, in inclusion to your fourth downpayment gets 50%.

Exactly How In Buy To Commence Betting About 1win Uganda

To add a brand new currency finances, log in to your own accounts, simply click upon your equilibrium, pick “Wallet administration,” in add-on to click the “+” switch to be capable to add a fresh money. Available alternatives consist of numerous fiat foreign currencies in add-on to cryptocurrencies just like Bitcoin, Ethereum, Litecoin, Tether, and TRON. After incorporating typically the brand new budget, an individual could arranged it as your primary foreign currency using the particular alternatives menu (three dots) subsequent to the wallet. Likewise, typically the web site features safety steps such as SSL encryption, 2FA in add-on to others. In Case you want in order to make use of 1win about your own cell phone device, an individual ought to choose which usually alternative works greatest for an individual.

- The Live Online Games area boasts a good remarkable selection, featuring top-tier choices for example Lightning Dice, Crazy Period, Mega Golf Ball, Monopoly Live, Infinite Black jack, and Lightning Baccarat.

- Browsing Through the particular legal scenery regarding online betting can become intricate, given the complex laws regulating gambling in addition to web actions.

- When your lossing is usually carry on and then consider a break in inclusion to arrive again together with more details about online game.

- These Sorts Of gambling bets focus on particular particulars, incorporating a great extra level associated with exhilaration and technique in purchase to your betting knowledge.

- Typically The recognition process is made up associated with mailing a duplicate or electronic digital photograph of an personality file (passport or generating license).

Sweet Bonanza At 1win Casino

just one win Ghana is a great platform that includes current on line casino plus sports activities wagering. This participant can unlock their prospective, encounter real adrenaline and acquire a possibility to be in a position to gather significant money awards. In 1win you could discover everything an individual want to totally dip your self inside typically the online game.

Now along with 1Win Sport typically the enjoyment associated with reside sports betting is always at your own convenience. You may appreciate reside streaming features and real period wagering functions. An Individual may enjoy reside matches across the particular globe plus occasions on this platform.

Events may contain several roadmaps, overtime scenarios, and tiebreaker conditions, which impact accessible market segments. The Particular downpayment procedure needs choosing a preferred payment technique, getting into typically the wanted amount, in add-on to credit reporting typically the deal. The Vast Majority Of build up usually are highly processed immediately, although specific methods, for example bank exchanges, may possibly consider lengthier depending on the particular financial establishment. A Few transaction companies might enforce restrictions about purchase quantities. Indeed, you could put fresh currencies to become able to your accounts, but changing your primary money may require support coming from consumer help.

1Win enables participants to additional customise their particular Plinko games along with options to become in a position to arranged typically the number associated with rows, risk levels, visual results in add-on to even more before actively playing. Presently There are furthermore intensifying jackpots attached to become capable to the particular online game upon typically the 1Win internet site. The popularity of typically the game likewise stems through typically the truth that will it provides an incredibly high RTP. If a person such as Aviator in add-on to need to attempt anything brand new, Lucky Jet is usually what an individual need. It will be furthermore a good RNG-based title that will functions likewise to be in a position to Aviator yet is different within style (a Fortunate Later on together with a jetpack instead associated with a great aircraft). Location a bet in a temporarily stop in between rounds and funds it out there right up until Blessed May well lures apart.

When a person desire in buy to take part within a competition, look regarding the foyer along with the “Register” standing. Proceed to the ‘Marketing Promotions and Bonuses’ section in add-on to an individual’ll usually end up being mindful associated with new gives. To End Up Being Capable To make contact with typically the help staff via conversation a person want to log within to typically the 1Win site plus locate typically the “Chat” switch in the particular bottom part correct nook. The Particular talk will open up within front regarding a person, wherever you may identify the particular substance regarding the particular charm plus ask regarding suggestions inside this or that scenario. This Particular gives site visitors the particular chance to select typically the most easy way in order to help to make dealings.

Inside certain, typically the efficiency regarding a player over a period of period. Make Sure You take note that every reward has specific problems that will want to end upwards being thoroughly studied. This Specific will help an individual take advantage of the company’s offers plus get the particular the the higher part of out there associated with your own site. Likewise retain a great vision about up-dates and fresh special offers to help to make sure a person don’t overlook away about the particular opportunity in buy to obtain a great deal regarding bonuses and items through 1win. JetX functions the particular programmed perform option in addition to provides complete stats that a person may accessibility to become able to set with each other a solid method.

- Every reward code arrives with restrictions regarding the particular quantity regarding possible activations, currency match ups, and quality period.

- Confirmation, to open typically the drawback component, you require to complete the particular registration in addition to necessary identification verification.

- Right After that will, simply click to rewrite the particular money wheel and hold out regarding the particular result.

- The talk will open up inside front of a person, wherever a person may identify the particular fact associated with the particular appeal in addition to ask with regard to advice inside this specific or that circumstance.

- Regular participants might obtain back upwards in purchase to 10% of the particular sums these people dropped during per week plus take part in normal competitions.

- This Particular source enables customers to discover remedies with out requiring primary help.

The Particular sportsbook of the particular terme conseillé offers regional competitions coming from numerous nations regarding the planet, which often will assist make the particular wagering method diverse in add-on to thrilling. At the particular same time, an individual may bet upon bigger worldwide contests, with respect to instance, the Western Glass. Regarding more ease, it’s advised to download a convenient app available for each Android os in inclusion to iOS mobile phones. If you usually are interested in comparable online games, Spaceman, Lucky Jet plus JetX are usually great options, specially well-known together with customers from Ghana. Showing odds upon the particular 1win Ghana web site may be carried out inside several types, an individual could choose the particular most suitable option for yourself. Placing gambling bets inside 1win happens through a bet slide – it displays fundamental details regarding the particular chosen match, your current probabilities, potential profits based about the sizing associated with the bet, and so about.

In Sporting Activities Betting

With a easy cell phone app, betting on-the-go has never ever already been simpler, letting an individual remain glued to live occasions while playing. Enjoy various bonus deals and special offers particularly personalized regarding live betting, which include totally free wagers plus boosted chances. Track inside to be in a position to current messages in add-on to examine comprehensive match up statistics such as scores, team form, in addition to participant conditions to end upward being able to make informed selections. Protection is usually a top top priority at 1Win, specifically whenever it will come to repayment strategies. Typically The system employs advanced encryption technologies in order to protect users’ monetary details, ensuring that all transactions are usually safe plus confidential. Players could relax guaranteed that will their deposits plus withdrawals are safeguarded towards illegal entry.