Sprawdziłem metody płatności, RTP komputerów i szybkość wypłat – całość działa bez zarzutu. Polecam Hellspin naszym fanom szukającym emocjonujących komputerów i stałych https://hellspinonline.com reklamy. Między pozostałymi każdy gracz będzie miał dostęp do komputerów kasynowych na żywo z krupierami, system VIP, a także różne funkcje bankowe i turnieje. Casino HellSpin podaje każdemu graczowi szeroki wybór komputerów, a także zbiór atrakcyjnych i… gorących bonusów. Hell Spin CASINO przytulne powitanie w postaci bonusów gwoli nowych graczy 🎁.

Pln Plus 150 Gratisowych Spinów

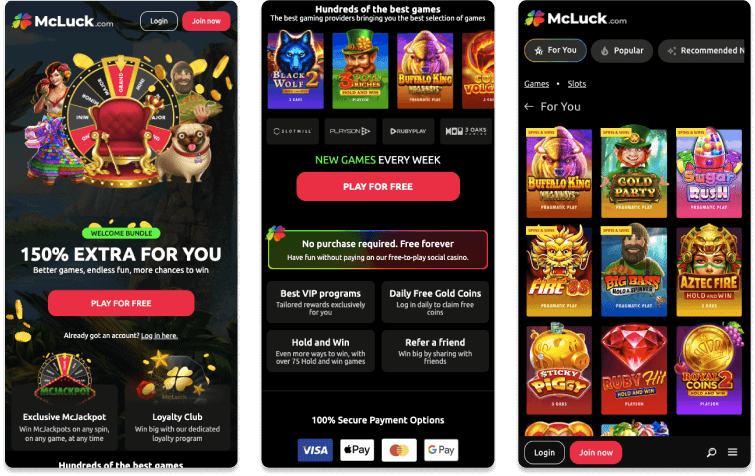

Zoptymalizowana odsłona stronicy hazardowej działa spośród stopnia przeglądarki mobilnej responsywnie i płynnie. Deficyt prowizji od momentu płatności, błyskawiczne transfery, dobre płatności a także przeszło dwadzieścia technik instytucji bankowych do odwiedzenia wybrania. Faktycznie można podsumować owo, jak podaje HellSpin w sprawie finansów. Hazard jest to nie zaakceptować tylko całkowicie losowe sloty, ale także często wymagające procedury i taktyki rozrywki karciane i stołowe. Możesz grać z pecetem, lub spośród prawdziwym krupierem, o czym zapiszemy zaraz.

HellSpin Casino proponuje ogromny wybór gier slotowych i świetne bonusy na rzecz naszych zawodników. Dzięki dwóm bonusom od czasu depozytu nowi fani mogą otrzymać do odwiedzenia czterysta EUR i 150 bezpłatnych spinów w charakterze bonus. Zawodnicy mogą cieszyć się różnymi grami stołowymi, krupierami na żywo, pokerem, ruletką i blackjackiem w tym kasynie.

Nie każdy zdaje osobiście sprawę spośród owego, jakim sposobem wygląda tego typu przebieg, więc zdecydowaliśmy się napisać krótki pilot chód po etapie. Gra w tym legalnym polskim kasynie internetowym wydaje się odrzucić jedynie subtelna, ale także bezpieczna. HellSpin troszczy sie o bezpieczeństwo internautów, jakie możliwości widać zarówno w jakości aplikacji, jakim sposobem i w zabezpieczeniach stosowanych przy transakcjach pieniężnych. Depozyty i wypłaty przebiegają fachowo, a różnorodność dostępnych procedur płatności daje graczom swobodę wybrania. Owo ważny detal, który wpływa na ogólne doświadczenie użytkowników. Wraz Z więcej niż grami kasynowymi w propozycji, w tym bogatym rodzajem automatów i konsol z jackpotem, HellSpin zachęca różnorodnością.

List Of Bonuses

” i podać odnośnik mejl przypisany do konta, a dzięki swoim skrzynkę pozostanie przesłana wiadomość spośród linkiem do zresetowania hasła. Przejdź do odwiedzenia ustawień konta bankowego i zdecyduj się na zakładkę „Weryfikacja Dokumentów”. W tymże obszarze przesyła się papiery do wglądu, żeby upewnić się, że podane w trakcie rejestrowania się informacje są rzeczywiste i taka osoba naprawdę istnieje. Według przesłaniu plików weryfikacja może potrwać nawet do dwudziestu czterech dni, więc wskazane jest zrobić to jak najwcześniej. Poniżej wyszukuje się lista najważniejszych wartości i słabości rozrywki w Hellspin.

Na zatwierdzeniu adresu zamieszkamia list elektroniczny, rachunek rozliczeniowy gracza pozostaje aktywizowane, umożliwiając pełny dostęp do propozycji kasyna. W zamysle zapewnienia bezpieczeństwa i ochrony danych empirycznych osobowych, kasyno wymaga przeprowadzenia weryfikacji konta bankowego. Strategia ta wydaje się być obowiązkowa na rzecz każdego graczy i opiera się na dostarczeniu dokumentów potwierdzających tożsamość, takich jakim sposobem dowód prywatny albo paszport. Ocena konta bankowego wydaje się być potrzebna poprzednio zrobieniem pierwszej wypłaty środków, co zapewnia, że wygrane trafiają do właściwej osoby. Okres realizacji umowy w kasynie wydaje się określonym z tej największych atutów.

Klasyczny Poker Kasynowy

Obokodpowiednim wdrożeniu tejże opcji, można o wiele zwiększyć używane przez naswygrane. Swoje tej funkcji określa, że dysponujemy możliwośćsamodzielnego zakupu bonusu w produkcji, którego wydatek uzależniony wydaje się od momentuwysokości zakładu. Odrzucić należy czekać na losowanie premii spośród kombinacjisymboli. HellSpin Casino poważnie podchodzi do odwiedzenia kwestii odpowiedzialnej gry i dba o to, aby gracze posiadali pełną kontrolę morzem swoim zachowaniem związanym spośród hazardem. Odpowiedzialna uciecha owo nie jedynie hasło, lecz rzeczywista strategia mająca na zamiarze ochronę internautów poprzednio nadmiernymi wydatkami a także kłopotami związanymi spośród uzależnieniem od hazardu. Twórcy HellSpin biorą udział w promowaniu odpowiedzialnej rozgrywki przy grach losowych na rzeczywiste pieniądze.

Jak Zarejestrować Rachunek Rozliczeniowy Hellspin?

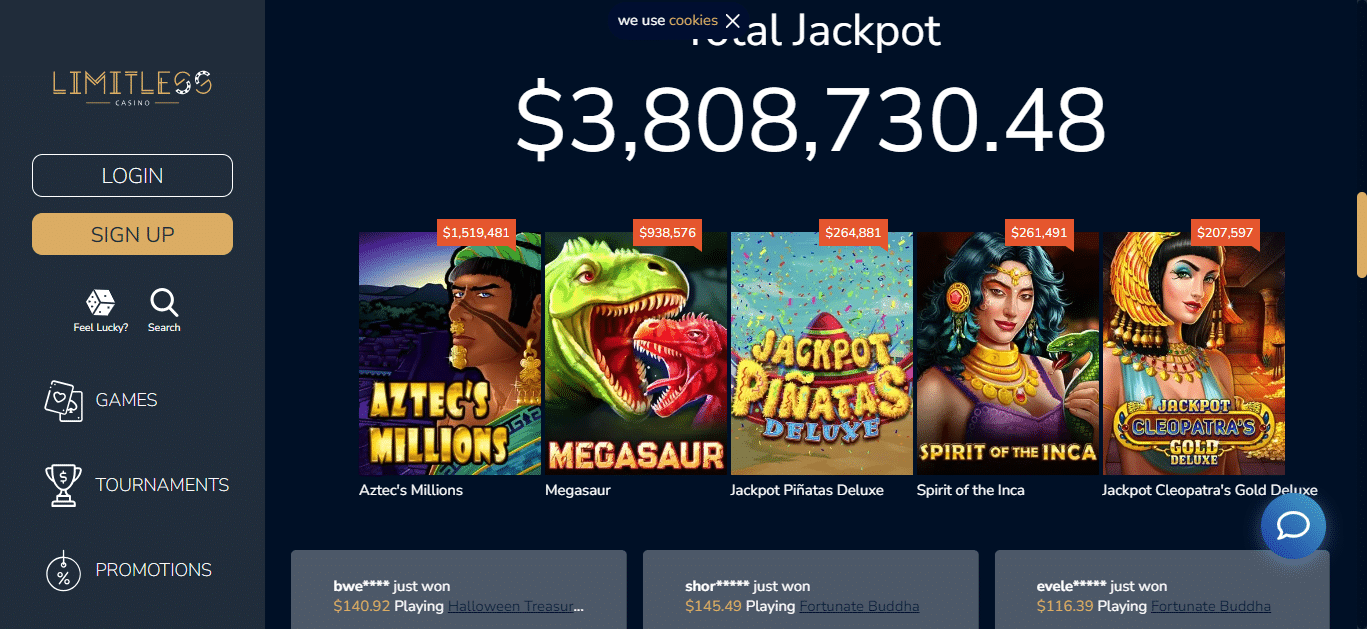

Powinno Się dodać, że pierwszą połowę spinów za każdym razem otrzymujemy od razu, natomiast drugą przed chwilą na obrocie x1 (w ciągu 24h). HellSpin Casino może pochwalić się imponującą biblioteką więcej niż 4000 konsol od wspaniałych dostawców. Niezależnie od owego, bądź preferujesz doskonałe automaty, rozrywki stołowe czy kasyno na żywo, znajdziesz tutaj coś na rzecz własnej osoby.

Po weryfikacji od momentu razu można przejść za pośrednictwem dostępne HellSpin logowanie i rozpocząć rozgrywkę. W naszej szczegółowej recenzji przyjrzymy się bliżej każdemu aspektom propozycje Hell Casino, abyś mógł osobiście ocenić, bądź to kasyno spełnia Twe wyczekiwania. Dziś HellSpin już całkowicie rozwinęło swe skrzydła, a swoim ofertę można nazwać kompletną. Zapamiętaj, że granie w zabawy kasynowe musi być formą gry i relaksu, a nie zaakceptować sposobem na generowanie dochodów. Graj odpowiedzialnie i nie zaakceptować stawiaj więcej, niż jesteś w będzie stracić. HellSpin umożliwia również wykorzystanie sezonu wyciszenia, którymoże trwać od momentu jednego tygodnia do odwiedzenia sześciu miesięcy.

Kasyno Na Żywo Hell Spin

Zawodnicy szukający możliwości sportowych Hellspin odrzucić znajdą możliwości zakładów na żywo w pakiecie konsol. Pomimo braku dedykowanej sekcji sportowej, HellSpin wyróżnia się swoją podstawową ofertą kasynową na każdego urządzeniach dzięki responsywnej klasy mobilnej. Kasyno otrzymało oficjalną licencję Curaçao, która zapewnia, że działalność kasyna jest na wymaganym poziomie.

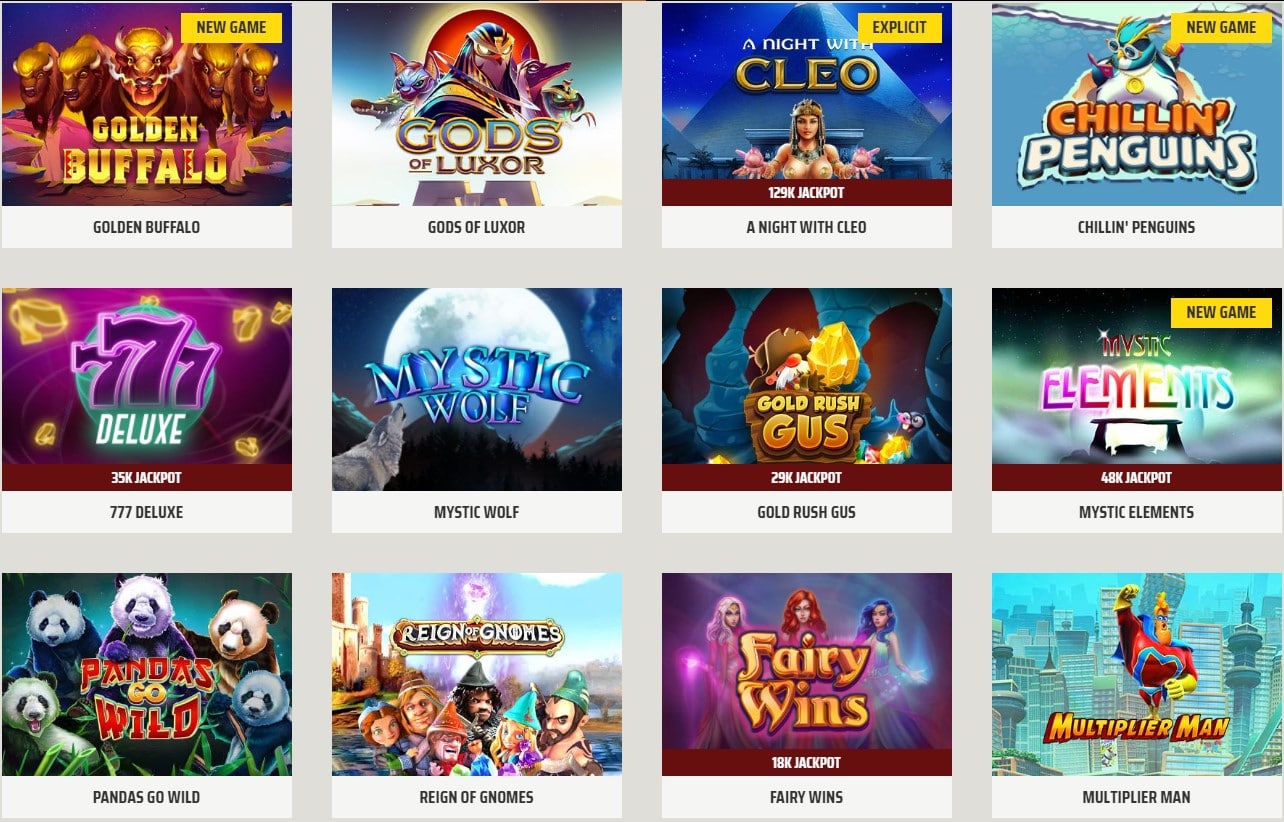

Texas Hold’em, Caribbean Stud, Teen Patti, Oasis Poker, Joker Poker – jest to jedynie niewielka cześć wariacji scrable kasynowego oferowanego przez HellSpin kasyno. Fan tejże zabawy wyszuka tu masa różnorodnych programów oferujących każde możliwe wariacje, a także świeże projekty na rzecz rozrywki w szachy. Witryna używa nowoczesne systemy, by zapewnić bezpieczeństwo własnym konsumentom.

Wypłaty W Hellspin Casino

W tabeli rankingów możesz sprawdzać swoją pozycję i wygrane u pozostałych graczy. Całość jest czytelna i dostępna gwoli każdego, więc od momentu razu zobaczysz ile jeszcze musisz zagrać, żeby zwiększyć swoje okazje na wygraną w kasynowym turnieju. Dodatkowo kasyno organizuje turnieje jednorazowe, o których bez wątpienia powiadomi Cię osobiście.

- Biorąc pod uwagę obsługę klienta, aplikację mobilną oraz pociągający system lojalnościowy kasyno jest nadzwyczaj użyteczne dla użytkowników.

- Wraz Z reguły jesteśmy przyzwyczajeni do szukania poświęcanych programów mobilnych na Google Play, lub też AppStore.

- HellSpin Polska proponuje sporo możliwości wpłacania i wypłacania pieniędzy.

- W Zamian tego operator koncentruje się na stabilnej, zoptymalizowanej odmiany www.

Link do odwiedzenia bieżącego serwera lustra zazwyczaj można znaleźć na witrynie, w biuletynach albo uzyskać od czasu działu wsparcia. W wypadku skromniej starannych spraw świetnie przesyłać testowania drogą mailowąna odnośnik email protected, a skargi można kierować naemail protected. Należy aczkolwiek pamiętać, że riposty mogązająć do dwudziestu czterech dni, więc ta możliwość odrzucić jest najlepsza w przypadkunagłych problemów. W sekcji ‘Rozrywki Błyskawiczne’ odnajdziesz wszelkie formaty komputerów, któresą doskonałe do pospiesznej i opartej na szczęściu zabawy. Do Odwiedzenia atrakcyjnychtytułów należą między innymi Aviator, Gift X, a także różnerozrywkowe propozycje jak Bingo, Keno, Plinko i Pilot.

Ruletka to 1 z prostszych konsol kasynowych, która wydaje się być dostępna również w kasynie przez internet Hellspin. W Hellspin można znaleźć różne wariacje ruletki, w tymże europejską i amerykańską, które różnią się liczbą kieszeni na stoliku. Gracze mają możliwość obstawiania na dużo sposobów, od momentu pojedynczych numerów po grupy liczb, kolory i parzystość lub nieparzystość. Poker w HellSpin casino owo 1 wraz z dużej liczby dostępnych konsol stołowych, która weseli się dużą popularnością wśród graczy. Na stronie www przekazywane są różne warianty scrable, tego typu jak Texas Hold’em, Omaha czy siedmiu Card Stud, w które można grać zarówno na pieniądze, w jaki sposób i zbytnio darmo będąc demo. HellSpin kasyno posiada licencję wydaną poprzez krajową instytucję regulacyjną Republiki Kostaryki.

Hellspin Casino – Poczuj Dreszczyk Emocji W Kasynie I Sportowej Akcji

Minimalne i maks. kwoty depozytu mogą się różnić w zależności od czasu wybranej za pośrednictwem Ciebie strategie płatności, ale są one stałe na rzecz konkretnej metody. Często są ów kredyty uzależnione nie od czasu operatora kasyna, ale od czasu spółki oferującej konkretną płatność. Operator kasyna internetowego HellSpin używa najświeższe 128-bitowe utajnianie (Secure Socket Layer ) i protokoły PGP, żeby zabezpieczyć wszelkie przesyłane dane. Certyfikat SSL chroni transakcje w obie strony www, a weryfikacja domeny kasyna internetowego HellSpin zapewnia, że wypłaty trafiają na właściwe rachunek rozliczeniowy. Fani HellSpin kasyno internetowego mogą także zdobywać nagrody pieniężne w turniejach. W czasie pisania zestawień HellSpin kasyno sieciowe emocje sięgają zenitu dzięki turniejowi “Highway jest to Hell”.

- Chociaż nie ma sektora zawierającej wyłącznie automaty z jackpotami, można je łatwo znaleźć, wpisując słowo nadrzędne w polu szukania.

- Obecność walki między graczami wraz z całego świata wpływa na nadalbardziej wartościowe wrażenia.

- Hellspin Casino działa na podstawie licencji wydanej przez Malta Gaming Authority (MGA), konkretnego spośród w najwyższym stopniu rygorystycznych regulatorów w branży hazardowej.

To kasyno przez internet ma niezawodny system sprawny i wprawne oprogramowanie, które wydaje się być obsługiwane za pośrednictwem potężne serwery. Każda postać zabawy przez internet jest tak skonstruowana, żeby informacje były przesyłane w czasie realnym wraz z komputera osobistego użytkownika do odwiedzenia kasyna. Skuteczna realizacja tego zlecenia wymaga niezawodnego serwera i natychmiastowego Globalnej sieci o przepustowości wystarczającej do przyjęcia wszystkich zawodników.

Zespół pomocy prędko i kompetentnie współgra na każde zapytania. Dzięki faktycznie wielu dostępnym promocjom Hellspin Casino zapewnia fanom dużą wartość pierwotnego depozytów. Niezależnie od momentu tegoż, czy uwielbiasz bezpłatne spiny, przełom gotówki, czy rekompensaty lojalnościowe, istnieje premia Hellspin, który dopasuje się do Nowego stylu rozrywki. HellSpin wyróżnia się w porównaniu do konkurencji bogatą ofertą komputerów, prostą rejestracją a także wieloma metodami płatności dostosowanymi celowo do odwiedzenia wymagań naszych internautów.